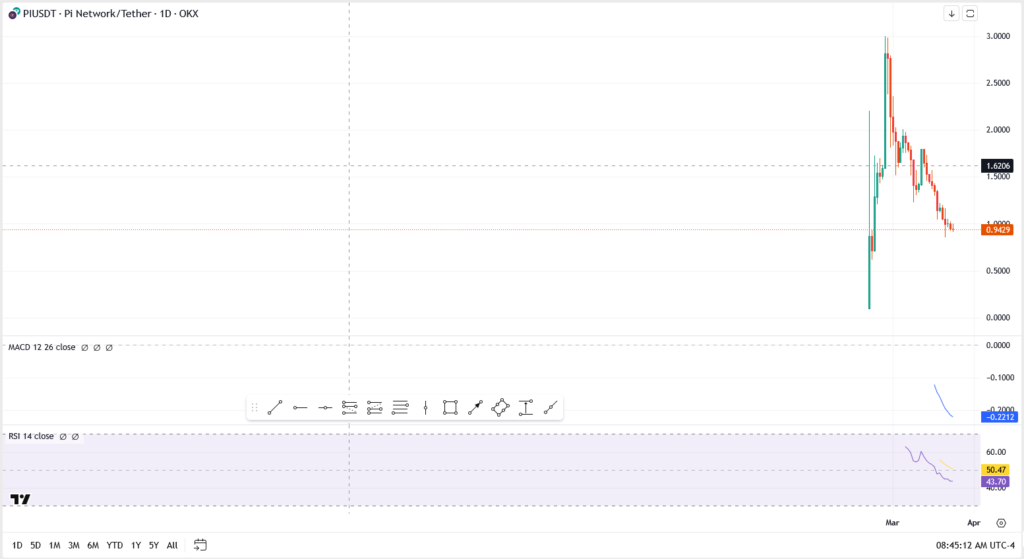

- Pi Coin slips below $1 as bearish momentum builds. Key support levels are under threat as traders brace for further downside.

Pi Coin Faces Downtrend Pressure Amid Weak Buyer Support

Pi Network (PI) is once again flirting with a decisive breakdown below the $1 level, trading at $0.94 at the time of writing. The latest price action shows mounting weakness, with technical indicators flashing bearish warnings across multiple timeframes.

The token, which briefly soared above $3 in early March, has since given up more than 65% of its gains, reflecting fading momentum and growing skepticism about its long-term tokenomics. Despite its vocal community, Pi remains unlisted on major exchanges, and current prices are based on speculative IOU contracts, adding further risk for retail buyers.

Technical Analysis: Breakdown Below $1 Could Trigger Panic

Even though Pi Coin’s trading structure is unusual, some public exchange data gives us enough to outline the current technical outlook:

- Current Price: $0.87 – trading decisively below the $1 psychological barrier

- Immediate Resistance: $1.10 – formerly strong support, now flipped

- Next Resistance Zone: $1.25 – a breakout above this would change short-term sentiment

- Key Support: $0.83 – if this fails, prices could drop toward $0.60 levels

- Momentum: RSI indicators suggest weak demand and continued bearish momentum

Is This the End for Pi Coin?

The current dip raises valid concerns, but calling it a total collapse might be premature. The future of Pi Coin hinges on a few key developments:

What Needs to Change

- Open Mainnet Launch: Until Pi holders can freely withdraw or trade, the price will remain artificially constrained.

- Major Exchange Listings: Binance, KuCoin, or even a mid-tier exchange would add crucial liquidity and legitimacy.

- Real-World Use Cases: Pi must evolve beyond speculative hype to survive long term.

Without these milestones, Pi risks fading into crypto obscurity—despite its large user base.

Final Thoughts: Collapse or Comeback?

Crashing below $1 is a big psychological blow for Pi holders, but it’s not necessarily the end—yet. Until the Pi Network team delivers on its promises, the coin will remain in a speculative grey zone.

For now, investors should stay cautious and avoid overcommitting unless key updates are officially rolled out.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.