- Platinum price declined slightly on Monday after the relatively mixed economic data from China. What next for platinum prices?

Platinum price declined slightly on Monday after the relatively mixed economic data from China. The precious metal’s remarkable rally took a breather and reached a low of $956, which was slightly below this month’s high of $971. The price remains about 15.2% above the lowest level this year.

China data and stimulus

Platinum price dropped after China published weak industrial production data for July. The statistics agency said that industrial production declined from 3.9% to 3.8%. This drop was smaller than the median estimate of 4.6%. In addition, retail sales dropped from 3.1% to 2.7%, while fixed asset investments eased from 6.1% to 5.7%.

These numbers mean that the economy is having some issues as the recovery gains steam. As a result, the People’s Bank of China (PBoC) decided to provide further stimulus to the economy. It lowered interest rates on the 400 billion yuan medium-term lending facility to some institutions. As a result, the rate dropped from 2.85% to 2.75%. This rate cut was a surprise since most analysts were expecting the bank to leave it unchanged.

Platinum price will next react to the important economic data from the United States. The country will publish the latest retail sales data on Wednesday. Economists expect the data to reveal that the country’s sales declined in July even as inflation eased. In addition, the Federal Reserve will also publish minutes of the past monetary policy meeting.

Further, the US will publish the latest American industrial and manufacturing production data, building permits, and housing starts data. All these numbers are significant because they measure the demand for platinum.

Platinum price prediction

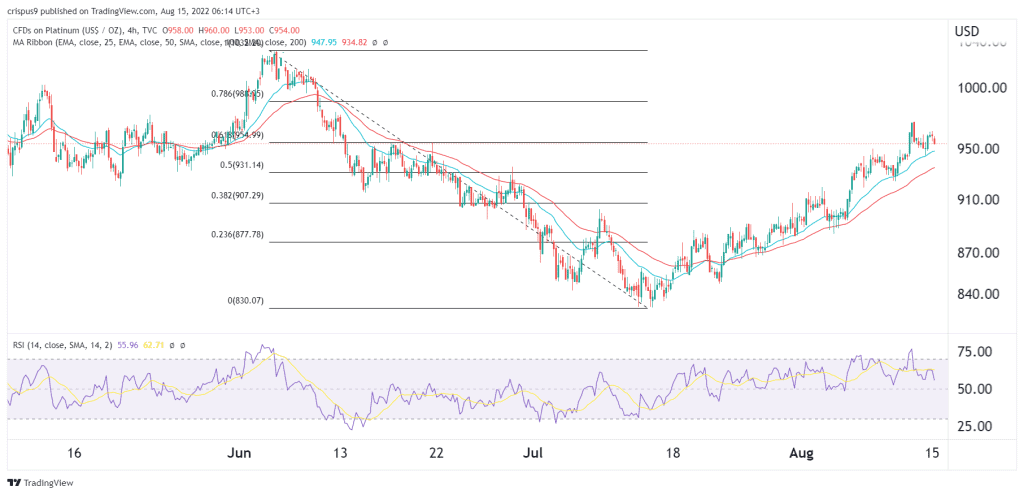

The four-hour chart shows that the platinum price has been in a strong bullish trend in the past few weeks. It has managed to move to the 61.8% Fibonacci Retracement level and above the 25-day and 50-day moving averages. The Relative Strength Index (RSI) has moved slightly below the overbought level.

Therefore, like I wrote last week, platinum will likely continue rising in the coming weeks as buyers target the next key resistance level at $1,000. A move below the support at $900 will invalidate the bullish view.