- What is the Tesla stock price forecast? We explain whether Tesla is a good investment in the long term and identify price targets.

Tesla (NASDAQ: TSLA) stock price has been on a scintillating run in the last month, gaining 42% in that period, including 8.8% rise in April. The momentum is driven by renewed optimism after the United States and its trade partners began striking trade deals, halting weeks of high tariff turmoil. In addition, CEO Elon Musk’s commitment to stay at the helm for the next five years has boosted investor confidence.

TSLA stock price trades at $346 as of this writing, its highest level in twelve weeks. In addition, its market cap reclaimed the $1 trillion dollar mark, lifting it to become the tenth most valuable company in the world by that metric. Moreover, the stock is supported by news of CEO Elon Musk’s reduced engagement with the Department of Government Efficiency (DOGE). However, TSLA is still down by 11.1% year-to-date as of this writing.

In addition, there is strong optimism among investors as its debut robotaxi trials in Austin, Texas draws near. However, the upside momentum has cooled down as of early May, as investors take a cautious approach ahead of the robotaxi piloting. Tesla stock price return above the psychological $300 support level comes after back-to-back declines in February and March.

The company’s revenues fell by $19.34 billion in the quarter ending March 2025, translating to a 9.23% YoY decline. In addition, net profit margin declined by 67.5% and its EPS missed forecasts by 34.8%.

That was hardly a surprise, considering the harsh economic environment created by shifting US trade policy. In addition, Musk’s controversial political statements and involvement with DOGE might have played a part, with a particular negative publicity seen in Europe.

Tesla sold 54,020 vehicles during the period, a 37% decline from the 86,027 units sold in the corresponding quarter in 2024. That was a sharper decline than the overall 13% YoY drop to 336,861 units sold globally during the quarter.

Tesla Stock Price Today

As of July 2025, Tesla stock is trading between $325 and $346, following a volatile period driven by mixed earnings results and growing anticipation around its upcoming robotaxi launch. The stock has shown signs of consolidation after a brief recovery from earlier lows this year.

Tesla’s Next Growth Frontier

CEO Elon Musk previously stated in 2024 that the company would pay greater attention to autonomous driving, powered by AI. At the helm of that mission is the development of Robotaxis, whose market trials will begin in Austin, Texas, in June 2025 That is barely one month away, and it will likely provide bullish undercurrent in the coming weeks.

TSLA price traded below the 20, 50, 100 and 200-day EMA as of this writing, denoting a downward-leaning momentum. However, its not all gloom. Tesla announced during the Q2 2024 that it will also be focusing on producing sub-$30,000 units built around the Model 2. The move is expected to make Tesla more affordable to more users, hence enable it compete with Chinese rivals. Also, by diversifying its market through robotaxis, Tesla is building a niche market where it could have an upper hand against its competitors.

Also, Musk negotiated his way through China’s data sharing hurdles during his visit to China a year ago. The move is expected to open a pathway for a wider adoption of Tesla’s Full Self Drive (FSD) service, which it considers a key growth driver. Furthermore, Musk will reduce his presence in DOGE to only two days a week starting May 2025, freeing up more time to focus on strengthening the EV company’s performance. These factors augur well for Tesla stock price.

Tesla Stock Performance in 2025: Impact of U.S. Politics and European Sales Decline

Tesla’s stock performance in early 2025 has been a rollercoaster, reflecting both macroeconomic trends and company-specific challenges. While Tesla remains a dominant player in the EV market, its European sales have taken a hit, partly due to Musk’s involvement in both U.S. and European politics, which has sparked controversy among consumers.

His outspoken views and engagements in political debates have led to a decline in Tesla’s brand perception in key European markets, impacting demand. Meanwhile, in the U.S., shifting EV policies and government incentives have added to market uncertainty, influencing investor sentiment. Despite these headwinds, Tesla continues to push forward with production ramp-ups and technological advancements, keeping the stock in focus for traders and long-term investors alike.

Tesla Update: Tightening Competition In China

Tesla has been facing rising competition in China, and that is about to go a notch higher with the launch of Xiaomi’s YU7 electric SUV. The vehicle is seen as a direct competitor to Tesla’s Model Y, the American EV maker’s best-selling model in China. The YU7 is 8 inches longer than the Model Y, has impressive specifications and comes with up to 759 kilometers (472 miles) range and a price bracket of between $35,000-$40,000.

Tesla’s Recent News

As of July 2025, Tesla stock is trading between $325 and $346 after a volatile period driven by earnings misses and anticipation around its robotaxi launch.

Analysts remain divided. Morgan Stanley raised its bull case to $800, while Mizuho targets $515–$681 due to progress in FSD and autonomous vehicles.

ARK Invest continues to forecast a long-term price target of $2,600, supported by Tesla’s expected dominance in AI and robotaxi fleets.

However, Tesla’s recent Q1 2025 report revealed a 67.5% drop in net income, and its European market share declined to just 0.7%, signaling potential risks for long-term investors.

New Model 3 Performance Unveiled

Tesla introduced the Model 3 Performance, featuring 460 horsepower and an acceleration of 0-100 km/h in just 2.9 seconds. The new version aims to attract performance enthusiasts and compete with high-performance electric vehicles.

Cybertruck Earns 5-Star Safety Rating

The Tesla Cybertruck received a five-star overall safety rating from the National Highway Traffic Safety Administration (NHTSA), with particular excellence in side crash scenarios. This reinforces Tesla’s commitment to safety in its innovative EV lineup.

Tesla Recalls Over 375,000 Vehicles

Tesla is recalling Model 3 and Model Y vehicles due to a potential power steering issue. The company has responded swiftly with an over-the-air software update, ensuring minimal disruption for owners.

Nissan-Tesla Investment Rumors Dismissed

Reports emerged that Nissan might be seeking an investment partnership with Tesla, but Elon Musk has denied these claims, clarifying Tesla’s independent growth strategy.

Trump vs. Musk on India Expansion

A rare disagreement surfaced in late February between Donald Trump and Elon Musk regarding Tesla’s India expansion plans. This geopolitical tension adds another layer of complexity to Tesla’s global strategy and supply chain considerations.

Federal Regulators Cite Tesla for Safety Violations

Regulators have cited Tesla for workplace safety violations following a worker’s death at its Austin factory. This raises concerns about Tesla’s labor practices and regulatory scrutiny.

Tesla Stock Technical Analysis

Key Support & Resistance Levels

- Current Price: $274

- Resistance Levels: $293, $320

- Support Levels: $250, $222.

Technical Indicators

- RSI : 53.67 – Suggesting neutral to bullish conditions.

Tesla Stock Outlook: What’s Next for TSLA In The First Quota of 2025?

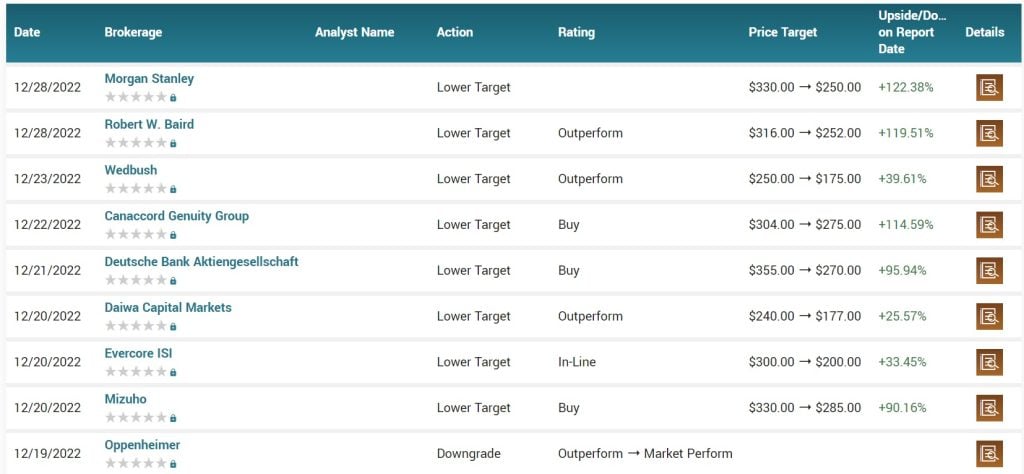

Several analysts have recently updated their forecasts:

Morgan Stanley’s Adam Jonas raised his bull case to $800, with a base scenario of $430, citing Tesla’s long-term potential in AI-driven mobility and services.

Mizuho Securities’ Vijay Rakesh upgraded Tesla to Outperform with a new target range between $515 and $681, largely based on progress in Full Self-Driving (FSD) and the expected launch of the Cybercab robotaxi in mid-2025.

24/7 Wall St projects that Tesla could reach $351.73 by the end of 2025.

TradersUnion sees a more moderate price of $341 by year-end, with a long-term target of $392 in 2029.

ARK Invest, led by Cathie Wood, maintains one of the most bullish long-term projections, estimating Tesla could reach $2,600 within 5 years, driven by large-scale monetization of robotaxi services and AI capabilities.

Tesla remains a highly watched stock, with a mix of positive product developments and regulatory challenges shaping its trajectory. Investors should monitor the $358 resistance level for a potential breakout or a drop below $340 for a bearish shift.

With the Model 3 Performance launch, strong Cybertruck safety rating, and India expansion plans, Tesla’s long-term growth narrative remains strong. However, concerns over recalls and workplace safety violations could lead to short-term volatility.

Tesla’s China competition

Tesla’s China rivals BYD, Xpeng and Nio reported better-than-expected deliveries in April 2025. BYD sold 380,089 units NEVs up by 21.24% year-on-year, in what was its fifth successive record-breaking monthly sale.

Tesla saw its sales decline for the fourth successive month in Germany in April, delivering 885 units for the month, equivalent to a 45.9% YoY drop. UK sales were also poor, coming in at 512 units sold, down from 1,352 sold in April 2024. That figure resulted in Tesla’s share of the UK vehicle market decline from 12.5% to 9.3% YoY in April.

On the other hand, Chinese EV maker, BYD saw its UK sales grow by 658% to 2,511 in April . Meanwhile, its sales in Germany grew by more than eight times to 2,566 units.

Elsewhere, another Chinese EV manufacturer, Nio sold 23,900 cars, its second-highest ever monthly sales. Tesla sold 336,681 vehicles in Q1 2025, a 13% YoY decline. Furthermore, the figure missed analysts’ estimate of between 360,000 and 370,000 vehicles for the quarter. The company does not release its monthly sales figures in China, but attributed its earnings decline to tightening competition in China.

With China offering subsidies to its EV manufacturers, former US President Joe Biden announced on May 14 2024 a four-fold increase in the tariff rates for EVs made in China from 25% to 100%. That figure was then raised higher under Donald Trump to reach 145% on all imports from China. In retaliation, China slapped 125% interest on US goods.

However, the world’s two largest economies agreed to cut trade tariffs on May 11, with the US rates slashed to 30% and China truncating its tariffs to 10%. The rates will remain effective for 90 days pending the outcome of trade negotiations between their delegations. As a result, Tesla stock price outlook has renewed impetus for near and medium-term gains.

The company announced in mid-2024 that it had reduced the price tag on its Full Self Driving (FSD) software from $1,2000 to $8,000 for its US customers. Tesla has been constantly lowering its prices in different regions since the start of 2023. While this has improved the company’s sales, the profit margins have also taken a big hit.

Tesla Full Self Driving and Robotaxis

In late March 2024, Tesla announced the availability of Full Self Driving (FSD) Beta v12 , a software built with fully autonomous driving capabilities, including steering, accelerating and braking for other vehicles and pedestrians within its lane.

Tesla CEO Elon Musk also announced that the company would offer its North American customers a free test on its FSD for a month. The announcement saw TSLA share climb more than 5% in the hours that followed, with more upside anticipated. According to Musk, the FSD has the potential to become one of Tesla’s leading revenue earners.

The software is prized at $12,000 a piece, but Tesla owners have the option of choosing a monthly subscription option ranging between $99-$199. The groundbreaking technology is touted for its safety-focused approach and the convenience it promises car owners. Furthermore, Musk has ordered that all prospective customers be offered demos on the software’s use.

The FSD v12 Beta had been on trial mode for a long period, with its deadlines pushed forward multiple times. Therefore, its official launch is likely to bring the mojo back to TSLA and could see shares rise significantly in the coming weeks.

Tesla Price War

Elon Musk’s electric car maker has also revised its prices in its two leading markets in recent times. In the United States, customers who trade in their old vehicle for a new Tesla by March 31 2024, will receive 5,000 free Supercharging miles. In February, the company offered a discount of $1,000 on its Model Y rear-wheel drive and Model Y Long Range.

In China, the company announced incentives worth about $4, 800 for customers buying existing stocks of Model 3 sedans and Model Y SUVs.

Another notable Tesla stock news was Bill Miller, a legendary investor is shorting Tesla. He warned that he would continue shorting the stock if it made more positive moves. His rationale was that Tesla was highly overvalued as it was valued at a higher valuation than the other five auto companies like General Motors, Ford, and Toyota.

What is the Tesla market cap?

The falling share prices have precipitated Tesla’s fall from the top 10 ranked companies globally by market capitalisation. The company has shed more than a 17% its value in 2025, resulting in sentiment around it. There are currently 3.19 billion total outstanding shares of Tesla in the market. Multiplying the current Tesla stock price of $322 with the total outstanding shares gives a Tesla market cap of $1.02 trillion. That makes it the world’s 10th most valuable company by market capitalisation.

Tesla Market Cap in 2025

As of May 13 2025, Tesla’s market value is about $1.02 trillion, up from $855 billion in late April. Investors monitor its performance in changing EV demand, political issues, and shifting industry conditions. Even with difficulties in Europe and regulatory ambiguities in the U.S., Tesla’s future growth potential remains a key interest for institutional and retail investors.

Musk Donates Tesla Shares

Elon Musk previously disclosed a Tesla stock (NASDAQ: TSLA) donation that he made in 2022 to a charity. According to a filing to the US regulator, the tech billionaire donated $1.95 billion in Tesla stock to charity in 2022. However, the name of the charity recipient, who received around 11.6 million shares, hasn’t been revealed.

Recently, Tesla has taken a step back from its plans to produce batteries in Germany. Instead, the EV maker will carry out the same production at its US facility due to favorable tax incentives. The discarded German battery facility was to be founded in Brandenburg, Germany.

Tesla Share Price History

Tesla launched its initial public offering in 2010. When it went public, the Tesla stock price was trading at a split-adjusted rate of $5. Since then, the TSLA stock has jumped by more than 28,000%, making it one of the best performers in the market.

While the long-term performance of the TSLA share has been good, the journey to the top has not been smooth. As shown below, the stock declined by 38% within a few months in 2015. Similarly, it then dropped by 56% within a few months in 2019. At the time, Elon Musk even warned that he had the funds secure to take the company private.

Is Tesla a good investment?

Tesla is a highly divisive company. On the one hand, there are die-hard fans like Cathie Wood who believe that the company will do well and thrive in the future. On the other side, there are analysts and investors like Scotty Kilmer and Bill Miller who believe that the promised future of EVs is only a mirage. He believes that there will be no mass demand for the company.

From a fundamental perspective, Tesla is no longer a good investment because of its valuation and competition. The company is valued at over $561 billion while companies like Toyota and Volkswagen are valued at less than $292 billion and $71 billion respectively. GM and Ford are valued at about $50 billion. Therefore, it is hard to justify Tesla’s valuation.

Further, the company is facing significant competition from incumbent companies like GM and Ford and upstarts like Rivian and Lucid. Rivian and Ford are its biggest threats because it has still not launched its truck product. Also, it is unclear whether the company’s truck will be successful since it seems like a relatively niche product.

Further, the company seems to be venturing in unchartered territory with its AI venture and focus on Robotaxis. This is a market that could require massive desruptive capabilities, considering that many people and governments still cringe at self-driving technology. If this venture fails, it could lead to massive losses by Tesla. Also, this is a long-term venture with a timeline of 6-10 years.

On the other hand, proponents say that Tesla has a strong market share in the EV industry, a strong supercharger network, and a loyal fanbase.

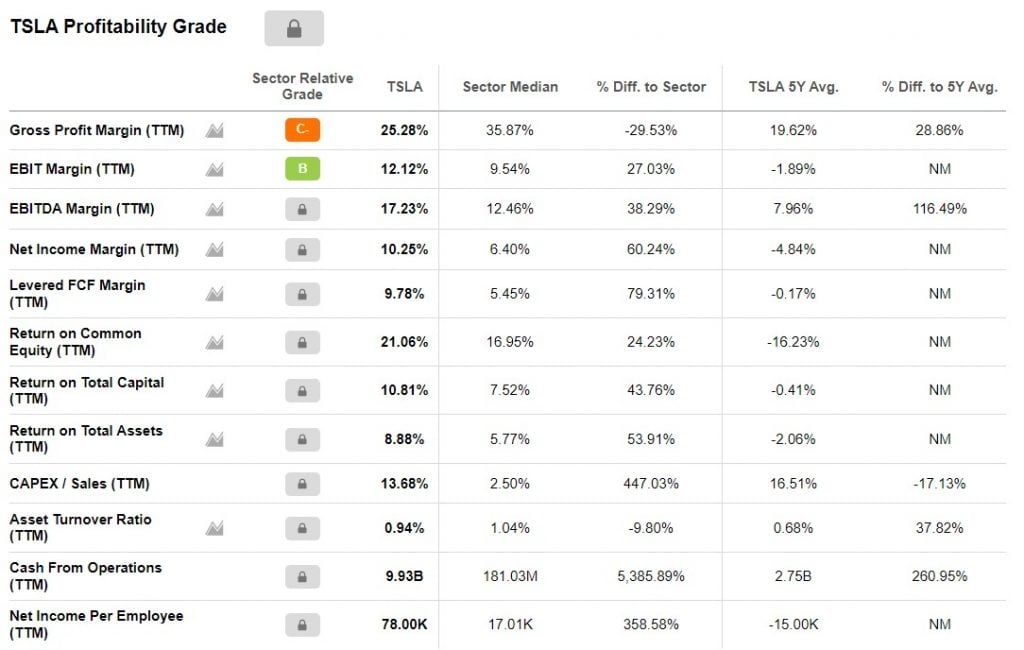

Is Tesla profitable?

A few years ago, there were concerns that Tesla would never be a profitable company. This view has changed recently when the company started making strong profits. It has a net income margin of 10%, which is expected to grow as it boosts its scale.

Tesla turned its first profit in 2020 when it made $862 million in net profit. The figure rose to more than $5.5 billion in 2021 and over $11 billion in the past four straight quarters. Tesla made a net income of $3.3 billion in Q1 of 2022 followed by $2.5 billion and $3.2 billion in the next two quarters. Also, after a 75% drawdown in 2022, Tesla stock price rebounded strongly in 2023. Therefore, we could see a repeat of the same trend in the near future.

Is Tesla overvalued?

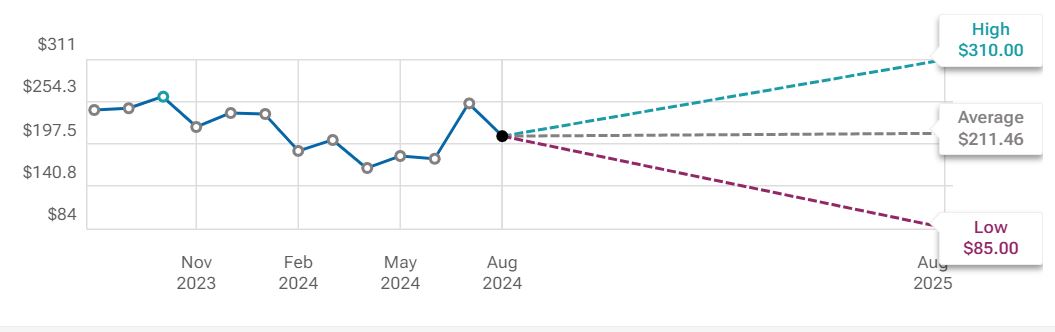

Most analysts believe that Tesla is an overvalued company. However, most of them justify this valuation because of its market share, revenue and unit growth, and upcoming projects including FSD and AI . According to a 12-month forecast by 31 analysts at tipranks.com, TSLA share price will likely be at an average of $211.46, with a high target of $310 and a low target of $85.00, signaling a substantial chance of volatility.

Tesla analysts forecast

Tesla Stock Price 2024

NASDAQ: TSLA currently trades above the middle Bollinger Band level of $211.78, and has critical support corresponding to the lower band at $188.40. Therefore, the upside will likely prevail if it stays above $211.78. However, a break below the support mark would be a red flag. Furthermore, a break above the upper band at $235.15 would denote a potential bullish rally.

Due to a lower low on the weekly chart, Tesla stock price forecast doesn’t appear to be very bullish for the next couple of months. This may change if the bulls clear the supply zone which lies above $204. Until then, there will always be another chance for the bears to make a comeback.

US inflation rate and Fed interest rate decisions will be major factors affecting Tesla shares and other US equities over the next few months.

Tesla stock price prediction 2025 and 2030

I expect that TSLA shares will be significantly higher than where they are today by 2025 and 2030. At the time, the company will be highly profitable as the world moves to electric cars. As shown below, analysts at Wallet Investor expect that the stock will be trading at above $300 in 2025. Similarly, Cathie Wood believes that the stock will be over $3,000 by 2030. Ron Baron, who is a very successful fund manager, expects the TSLA stock price to hit $1500 by 2030.

Tesla’s biggest shareholders

Tesla is a publicly traded company, meaning that anyone can buy the stock. As mentioned, Elon Musk owns about 13% of the company. At the same time, there are about 1,937 institutional investors who own 41% of the company. This means that retail investors own about 42% of the company. The biggest Tesla shareholders are Blackrock, Vanguard, Capital Group, and Baillie Gifford.

Tesla Stock Outlook: 2025 Performance and Long-Term 2040 Prediction

Tesla Stock Prediction for 2040

By 2040, Tesla’s business is likely to look very different from today. The company has ambitious goals, ranging from self-driving cars and robotaxis to energy storage and AI-driven automation. If Tesla successfully expands into these areas, its valuation could multiply, making it one of the most influential companies of the decade. However, competition in the EV and AI sectors will be much fiercer, meaning Tesla will need to maintain its technological edge to remain dominant. While some analysts predict Tesla stock could trade above $3,000 per share by then, others warn that regulatory challenges and shifting market trends could slow its growth.

Tesla Stock Summary: February 2025

Tesla’s stock has faced a turbulent start to 2025, balancing growth optimism with political and market pressures. The company’s $1.2 trillion market cap reflects its strong position, but recent European sales declines due to Elon Musk’s political influence in the region have raised concerns among investors. Meanwhile, U.S. policies on EV incentives, tariffs, and competition from Chinese automakers are shaping Tesla’s outlook.

Despite these challenges, Tesla continues to push forward, with new vehicle models, improved battery technology, and AI-driven advancements keeping it in the spotlight. Whether the stock can regain bullish momentum will depend on demand trends, production efficiency, and the company’s ability to navigate shifting regulations.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.