- USDINR forecast 2025 is bullish as a slowdown in the Indian economy, multiple RBI rate cuts and trade tariff war weigh in.

The USD/INR forex pair has experienced a period of significant volatility since July 2025, with the Indian Rupee facing sustained pressure and trending toward new lows. The primary driver of this depreciation has been the introduction of new US trade tariffs on Indian goods, a major shift in the bilateral economic relationship.

Since the beginning of July, the Rupee has steadily weakened against the Dollar. The initial imposition of a 25% US tariff on Indian imports on August 7, 2025, led to an immediate spike in the USD/INR pair. This was followed by a further, more punitive 25% tariff on August 27, bringing the total levy to a staggering 50% on many Indian products.

This move, which was reportedly a response to India’s continued energy purchases from Russia, has dented foreign investment sentiment and led to capital outflows from India, putting immense pressure on the Rupee. The rate has now consistently held above the 87.00 mark and has even touched a record low near 88.50.

This article was originally written in December 2024 and updated on September 18, 2025, to reflect recent developments, including Operation Sindoor, USD/INR price movements, and the impact of renewed U.S. tariff policies under President Trump. All technical levels and market commentary are based on the latest data available at the time of writing.

USDINR Outlook in 2025

Multiple interventions by the Reserve Bank of India supported the rupee for a significant portion of 2024, keeping the rate below 84.30 for the first nine months. However, the dollar’s safe haven status and weakness in the Indian equities market finally broke the rupee’s resistance in the fourth quarter.

2025 is turning out to be a different year, with different key factors at play. The key focal factors around the currency pair in 2025 will be global trade tariff wars, crude oil prices, Indian economic growth trajectory and Fed and RBI policy decisions. Also, the US economy faces turbulence in the face of its shifting trade policies. The world’s largest economy contracted YoY by 0.3% Q1 2025, adding to the pressure on the US dollar.

In addition, the geopolitical developments around India’s relationship with Pakistan could weigh in on the USDINR pair. An attack in the contested Kashmir region left 26 tourists dead in late April, and there’s an underlying risk of an escalation. As of this writing, Pakistan claims it has “credible intelligence” that India plans to attack it. An eruption of military action between the two nations could potentially be disruptive to their economies, but could provide tailwinds to USDINR.

RBI Interventions Limit Indian Rupee Losses Against the Dollar

USDINR has been on a strong uptrend since December 2024, driven by a strong demand from importers and high rate of foreign institutional outflows from Indian equities markets.

However, multiple interventions by the Reserve Bank of India (RBI) helped keep the rupee stable during a period when the dollar generally gained against major currencies. The central bank net-sold $36 billion in the second half of 2024, underlining a strong aggression towards the dollar.

Strong economic data and a positive outlook on the Indian economy helped the rupee hold off the dollar for the most part in 2024. Also, weak demand for oil, underlined by China’s economic struggles, put a lid on the USDINR pair. However, the last quarter of the year brought headwinds, with weak earnings and exits by foreign institutional investors from Indian equities markets weighing down on the rupee.

However, improved output by the Indian economy pushed the rupee to have strong show in March, gaining 2.3% in the month. The period saw increased institutional inflows as the Nifty 50 Index gained 6.3% and the Sensex went up by 5.76%. However, the trade tariff war ignited by the United States in late March has seen the rupee lose traction, with the USDINR pair assuming a choppy pattern in recent days.

Impacts of Interest Rates And Trade Tariff War

In December 2024, the Reserve Bank of India (RBI) revised downward its 2025 forecast for Indian GDP growth from 7.2% to 6.6%. That could be the lowest growth rate in four years and signifies a likely continuation of the release of soft economic data, which will support gains by USDINR.

Furthermore, the high tariff rate makes Indian exports to the US less competitive and could result in reduced dollar inflows into the Indian economy. However, the impact of the RBI rate cut could be offset by the likely cuts by the Federal Reserve.

The Fed was initially expected to make only two rate cuts in 2025. Nonetheless, recent back-to-back soft macroeconomic data, underlined by Non Farm Payrolls (NFP) numbers miss and unemployment rate spike in February and March have raised the prospects of more cuts.

In terms of the rest of 2025, the USD/INR pair continues to point in a negative direction for the Rupee. The most important thing will be how the US-India trade tariff problem is resolved. India’s Chief Economic Advisor has recently expressed confidence that the punitive tariffs could be lifted after November 30, but the prevailing uncertainty is likely to keep the Rupee weak.

A partial trade deal might help the currency stay stable, but it doesn’t look like the tariffs will be completely lifted anytime soon.

The Rupee’s value will also depend on monetary policy in India and around the world, in addition to tariffs.

Impact of Oil Prices on the Rupee

India is the world’s third-largest imported of crude oil, and the product’s price oscillations have a significant impact on the rupee. Dollar-denominated crude oil has experienced a slowdown in demand for the last year, as China’s economic growth declined.

According to the International Energy Agency (IEA), demand for the commodity is projected to rise by 1.05 million barrels per day (bpd) to a total of 104 million bpd in 2025. The growth is attributed to the recovery of China’s economy as stimulus measures yield fruits. A spike in the demand for oil could increase the price and fuel gains by USDINR.

That said, Russian Deputy Prime Minister Alexander Novak said that the OPEC+ oil cartel could reverse its decision to raise production in April if the demand continues to be weak. Crude oil prices dropped to six-month lows in early March, pushed by concerns over the impact of the trade tariff war.

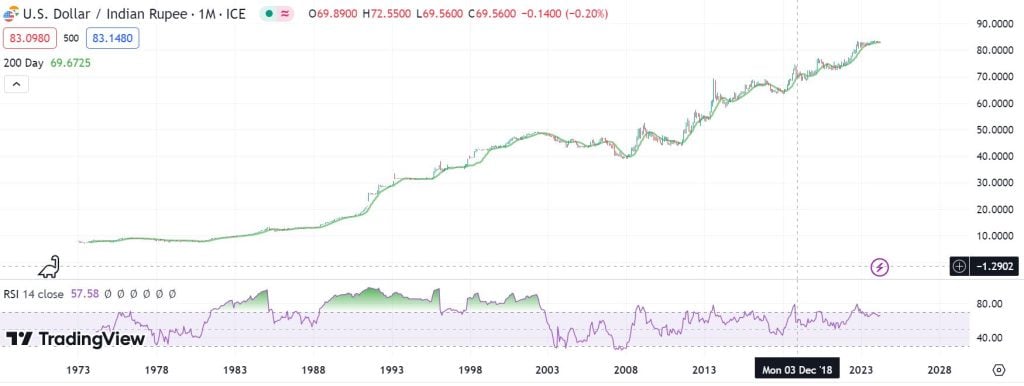

USD/INR Historical Chart

USD to INR trading dates back to 1973 when the pair was floated in the forex market at an opening price of $1 to 7.98 rupees. By late 1983, the currency pair rose past the psychological level of 10 rupees to the US Dollar. Between then and April 2002, it rallied by 376.41% to 48.76 rupees.

After retracing to 39.9 rupees in November 2007, the USD/INR has been on an uptrend since then. The pair surged to an all-time high of 83.47 on November 10th, 2023. Before attaining its all-time highs, the USD/INR tasted the 76.45 price mark in March 2020, just as the coronavirus pandemic was sweeping through the world.

As the US Federal Reserve started to hike rates, Indian rupee started to slide against the US Dollar. In October 2022, the pair surged to a new all-time high of 83.28. This ATH was refreshed in 2023. However, the dollar’s rally in 2024 saw it hit a new ATH on March 22.

Strain on Indian Equities Markets

There has been a notable selloff in the Indian stock markets by foreign institutional investors, leading to elevated dollar demand since the fourth quarter of 2024. The trend has been exacerbated by elevated US treasury bond yields, and it might take a while before we see. Therefore, we are likely to see the USDINR stay on the rise in the medium term, with marginal gains by the rupee.

April Recap: Operation Sindoor Shakes Sentiment as Rupee Recovers

April didn’t end quietly. Operation Sindoor, India’s surgical strike on terror camps across the border, dominated headlines in the final stretch of the month. While markets initially shrugged off the geopolitical flare-up, the Indian rupee managed to stage a sharp recovery, helped by a weakening U.S. dollar and softer global yields.

USD/INR dropped from above ₹86.00 to as low as ₹83.00, catching many by surprise. But the bounce late in the month suggested the rupee’s strength was more tactical than structural.

Updated on 25/5/2025

USD/INR Weekly Outlook: Rupee Faces Resiatnce At 88.50 US-India Tariff Talks Signal Hope

The US Federal Reserve has just slashed interest rates in September, and some analysts believe that it will lower rates again before the year ends. This could, in theory make the US Dollar weaker and help the Rupee.

However, the Reserve Bank of India (RBI) is likely to take a dovish approach, which will probably cancel this out. The RBI is also under pressure to lower its own rates to help the economy in the face of trade-related problems and falling inflation. Therefore, a synchronized round of rate cuts might not be enough to help the Rupee, which really needs it.

What’s Happening on the USD/INR Chart?

- Buyers stepped in around 87.59, keeping things stable so far

- But 88.45 is proving tough to crack — it’s acted like a ceiling all week

- If that level breaks, next upside target is 89.00

- RSI is steasdy — currently near 60

- MACD? Still in positive territory, but it’s losing punch

So, no clear breakout yet and honestly, price looks stuck unless something changes in the data narrative.

Behind the Move: All Eyes on the US

The dollar has stayed resilient this week, partly thanks to firm yields and cautious risk tone. Traders are holding off on big bets ahead of the US April retail sales and PPI reports, both expected to drop later today.

Meanwhile, crude has been creeping higher, which doesn’t help the rupee’s cause. And there’s still no sign of RBI stepping in, at least not yet.

Quick Take: Choppy, Waiting for a Trigger

Until the data lands, expect more of this chop between 85.37 and 85.80. If bulls manage to clear that upper range, the next target opens at 86.13, maybe even 86.61 if momentum builds. But if the dollar softens, USD/INR could slip back to 84.88 or lower.

It’s all about the next data drop now.

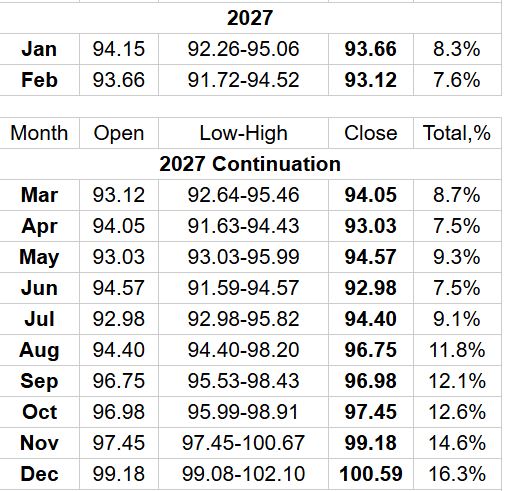

What will be USD to INR Rate in 2027?

Long Forecast’s USD to INR forecast 2027 suggests the start of the year around 94.15 rupees. It expects the currency pair to average 92.98 by mid-year before rallying further to 100.59 by the end of the year. The prices can go much higher if the global economy enters a prolonged recession after the ongoing deflationary measures.

It is important to note that the targets for September 2025 have already been met, while the price pattern on the daily chart indicates that there is a high potential for the October 2025 price target of 83.95 to be met in the second half of 2024. As it is, this makes the USD to INR forecast 2025 above quite viable, albeit with some minor differentials. It is crucial to conduct your own individual research.

USD to INR Forecast 2030

A feasible USD to INR forecast for 2030 is informed by the economic health of India and the US, Fed and RBI’s monetary policy, and the demand for the US dollar as a safe haven. Hence, a strong dollar will likely push USD to INR to a new record high, depending on the key drivers.

However, as an emerging market, India’s currency has the potential to strengthen further in the coming years. From that perspective, USD to INR forecast 2030 will be for the pair to remain within a range for several years.

How to trade USDINR

To trade USDINR, one needs to open an account with a reputable forex broker. When researching the best broker, it is helpful to consider their spreads, commissions, and other fees. It is also possible to trade the currency’s derivatives in the form of USDINR futures.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.