- The SP 500 index has recovered from opening losses as traders price in March interest rate hike by the Fed.

The SP 500 index started the trading day lower on the comments from Fed Chair Jerome Powell and those of other Fed governors. However, the sentiment has improved as the session progresses, sending the SP 500 index higher by 0.5%.

The Cleveland Fed President Loretta Mester said she would support any decision to raise interest rates in its March 15-16 meeting if inflation and labor market conditions evolve as envisaged. Mester said she was in for three rate hikes, as she spoke in a Bloomberg interview in a strongly hawkish mode.

Fed Chair Powell had earlier said in a Senate Banking Committee testimony on Tuesday that it was time for the Federal Open Market Committee (FOMC) to end monetary policy accommodation. Powell cited improved labor conditions and rising inflation as reasons for such action.

The Fed’s tapering program ends in March, which is when market analysts expect the Fed to implement the first of a potential three rate hikes.

SP 500 Outlook

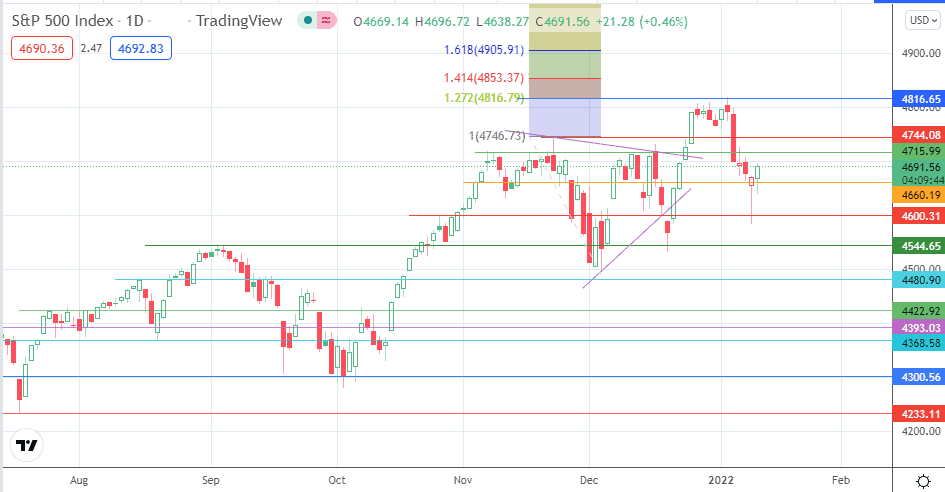

The active daily candle bounced off the 4660 price support and is inching towards the 4715 resistance mark. Further recovery that targets the all-time high at the 4818 price mark requires a break of the 4715 and 4744 resistance barriers.

A lack of bullish follow-through momentum could allow for a decline which puts the 4660 under pressure. If the bulls fail to defend this price mark, a run towards 4600 cannot be ruled out. 4544 and 4480 are additional downside targets if the bears force action lower.

SP 500 Index: Daily Chart

Follow Eno on Twitter.