- The Sainsbury's share price staged a strong rebound this week. In this article, we analyse if the rally has more room to run.

The Sainsbury’s share price staged a strong rebound this week. In this article, we analyse if the rally has more room to run.

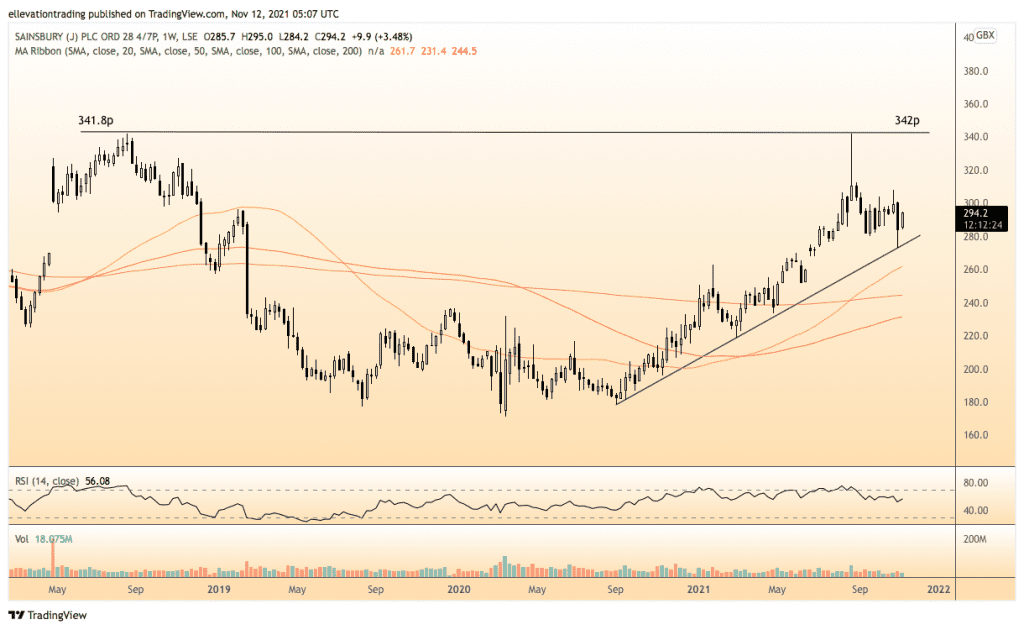

After a poor start to November, Sainsbury’s share price (LON: SBRY) has returned to its winning way’s this week. The U’K’s second-largest grocer came under pressure earlier in the month after supply-chain and inflation fears outweighed the impressive interim first half 21/22 trading statement. At the lowest point last week, SBRY was down almost 20% from the August 342p high. However, basis yesterday’s close, the loss has pared to -14%, improving SBRY’s year-to-date performance to +30.8%.

SBRY Price Analysis

A quick look at the weekly price chart highlights an encouraging development. The sell-off last week bounced perfectly from a long-term uptrend at 273.2p, reinforcing the trend’s significance. Therefore, the long-term trend is higher as long as the price remains above the line (now at 274p). So let’s take a look at some potential targets on the upside.

Although the first barrier is the psychological 300p threshold, I consider 310.40p more significant. A weekly close above 310.4p would be the highest since November 2018, which should encourage buyers. In that event, an extended rally could bring August’s 7-year high of 342p into the frame.

Of course, we must also consider potential supply-side shocks and inflationary stress. Therefore, the bullish view remains valid only as long as Sainsbury’s share price is in a rising trend. On that basis, a weekly close below 274p invalidates the thesis.

Sainsbury’s Share Price

For more market insights, follow Elliott on Twitter.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.