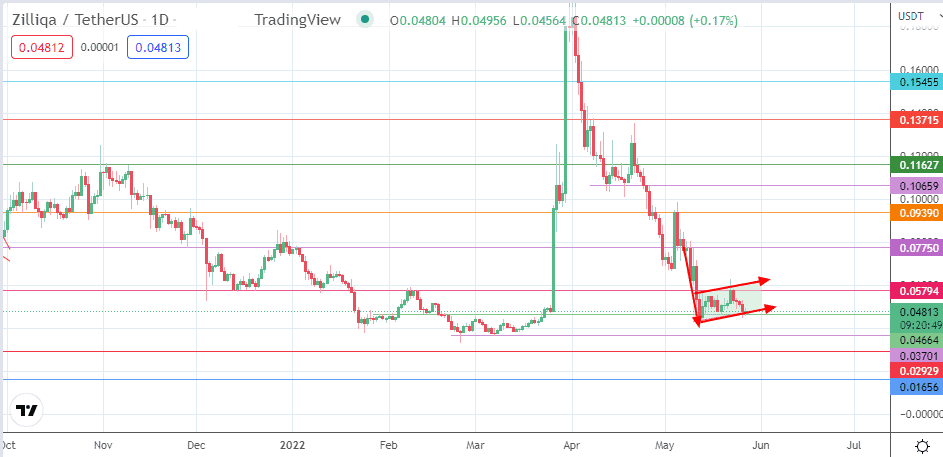

- A breakdown of the bearish flag enhances bearish Zilliqa price predictions of a drop to the 0.01656 price mark.

The evolving pattern on the daily chart is the bearish flag, which is causing a build-up of bearish Zilliqa price predictions. Price action on the Zilliqa chart shows that the bulls barely have the upper hand in Friday’s trading, with a 0.02% upside. This is barely scratching the four successive session losses sustained since Monday.

These losses erased last week’s gains and have put the support at 0.04664 in danger of collapsing. Zilliqa’s best month came in March 2022. This was when a rally late in the month sent it to new highs at 0.23070. But since attaining this high on 1 April, it has been downhill for the token.

The recent decline came just as founder Amrit Kumar stepped down as President. His position has been taken by CEP Ben Livshits (PhD), who also heads the project’s research and development arm. However, this has not resulted in any bullish Zilliqa price predictions or any uptick in price. The ZIL/USDT pair is currently down 16.73% this week. This could worsen if further price deterioration ensues.

Zilliqa Price Prediction

The ZIL/USDT daily chart shows an evolving bearish flag, as is the case with many altcoins. The price activity is testing the support at the 0.04664 price level, where the flag’s lower border is found. A breakdown of this double support clears the pathway for the bears to target 0.03701 (25 February and 7 March lows). The measured move

from the pattern’s breakdown ends at 0.01656 (30 October 2020 low). The bears will only meet this target if the 11 December 2020 low at 0.02929 is degraded. On the flip side, a bounce from the current support allows the bulls to mount a challenge against the 0.05794 resistance (8 February and 23 May highs).

If this resistance is overcome, 0.07750 becomes the next target in line. Above this level, additional price milestones lie at 0.09390 (4 May 2022 high) and 0.10659, where the 25 April high is found.