- What is the outlook of the Zephyr share price forecast? We explain what to expect in the near term as it consolidates.

The Zephyr share price has declined as energy stocks retreat slightly in the past three days. The ZPHR stock is trading at 6.05p, the lowest level since March 18 and about 13% below its highest level this month. This performance brings its market cap to about 94 million pounds, making it a relatively small company.

What is Zephyr?

Zephyr is a small American company that owns assets in places like Utah, North Dakota, and Colorado. The company was created to aggregate oil and gas assets in the Rocky Mountain region in the US. By acquiring interests from companies like Whitting Petroleum and Continental Resources, it does that. According to its website, Zephyr has interests in thousands of acres in the region.

As an exploration company, Zephyr is yet to start generating any meaningful income. Instead, the management is focused on investing sums of money to drill wells and acquire other projects. For example, the firm averaged just 148 barrels in its Williston Basin project. Of oil per day, Its most recent annual report showed that the firm had an operating loss of $2.3 million in 2020. Its net loss crashed to about $2.3 million.

In its most recent statement, the firm said it had completed four acquisitions, bringing the total number of wells to 22. In April last year, it raised 10 million pounds and started cross trading on the OTCQB Ventures market.

Zephyr share price forecast

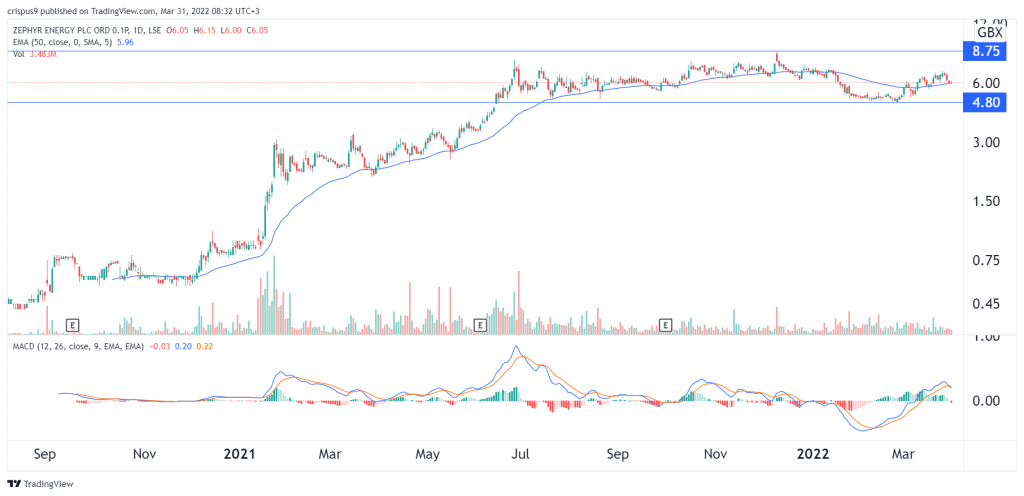

So, is the Zephyr share price a good buy? The ZPHR stock price has done well in Londo recently, considering that it has risen by more than 1,313% from its lowest level in August. It has also found a strong support level at about 4.8p, which was the lowest level this year.

The stock has even moved above the 50-day moving average in the past few days, while the MACD has moved above the neutral level. With the volume being a bit stable, there is a likelihood that the stock will keep rising as bulls target the next key resistance level at7p.

However, as a penny stock, ZPHR is a high-risk stock that can be volatile, making it difficult to recommend. A drop below the support at 5p will invalidate the bullish view.