VOO stock price has rallied in the past few weeks as investors focus on the recent earnings season and Federal Reserve policy. It also jumped as the fear and greed index moved from extreme fear to green. The ETF was trading at $392, which was higher than the year-to-date low of $334. Other top ETFs like Invesco QQQ and the DIA have also rallied by over 15%.

Is this a bear market rally?

VOO is one of the biggest exchange-traded funds (ETF) in the world with over $700 billion in assets. It is a cheap fund that tracks the performance of the S&P 500 index. The fund has an expense ratio of just 0.03%, making it significantly cheaper for investors.

The VOO stock price has jumped sharply in the past few weeks as investors have reacted to the recent earnings. According to FactSet, most companies that published their results have beaten expected earnings and revenues. However, as expected, earnings growth was the lowest it has been since 2020 as the soaring inflation affected profits.

Meanwhile, the fear and greed index has been in a recovery mode recently as it rose to the greed level for the first time in months. The VIX index has slipped to the lowest point since April this year, which is a sign that investors are comfortable buying rsky assets.

However, there are concerns about whether this is a real bull run or a bear market rally. There are chances that this is a real rebound. For one, stocks remain fairly valued, with the forward S&P PE ratio being at 17.5, which is lower than the five-year average of 18.6. Also, there are signs that the Federal Reserve will slow the pace of rate hikes.

VOO stock price forecast

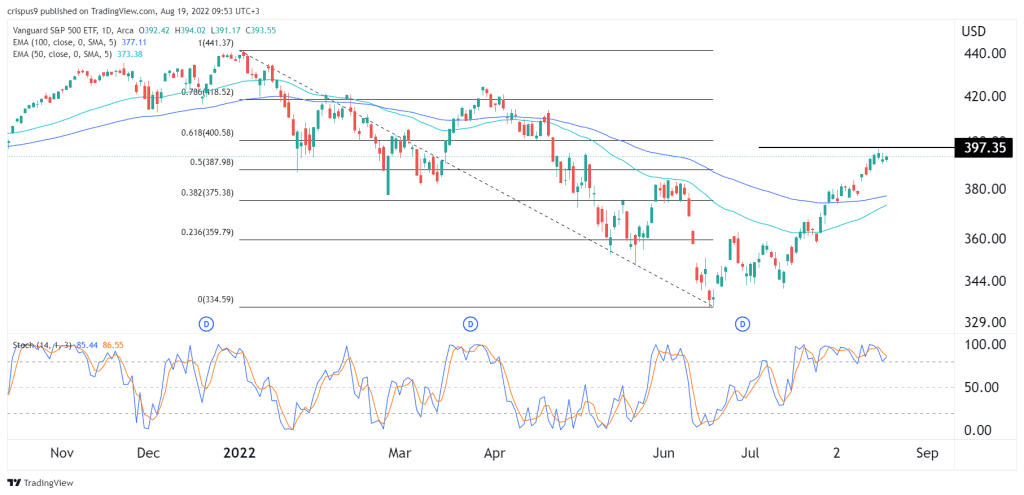

The daily chart shows that the VOO share price has been in a strong bullish trend in the past few weeks. Along the way, the ETF has managed to move above the 50% Fibonacci Retracement level. It has also moved above the 50-day and 100-day moving averages. The two are close to do a bullish crossover while the Stochastic Oscillator has moved above the overbought level.

Therefore, while a short pullback is likely, the stock will likely continue rising as bulls target the 78.6% retracement level at $420. A drop below the support at $380 will invalidate the bullish view.