The Vodafone share price started 2022 well as investors hope that the year will be better than in 2021. The VOD stock is trading at 117.45p, which is close to the highest point since September last year. It has risen by over 15% from its lowest level in December.

Vodafone had a difficult year in 2021 as concerns about its business rose. After rising to a high of 133.90p in May, the stock crashed by about 23% and reached a low of 102p. The shares declined as the Vodafone Idea crisis happened in India. The Indian company needed a government bailout as the telecommunication sector struggled.

Vodafone also faced increased competition in the UK from the likes of TalkTalk and BT Group. Still, there were some positives, including the fact that the company pushed Vantage Towers public. The stock managed to jump from a low of 23.6 euros to 33 euros. So, what next for the VOD share price?

Vodafone share price forecast

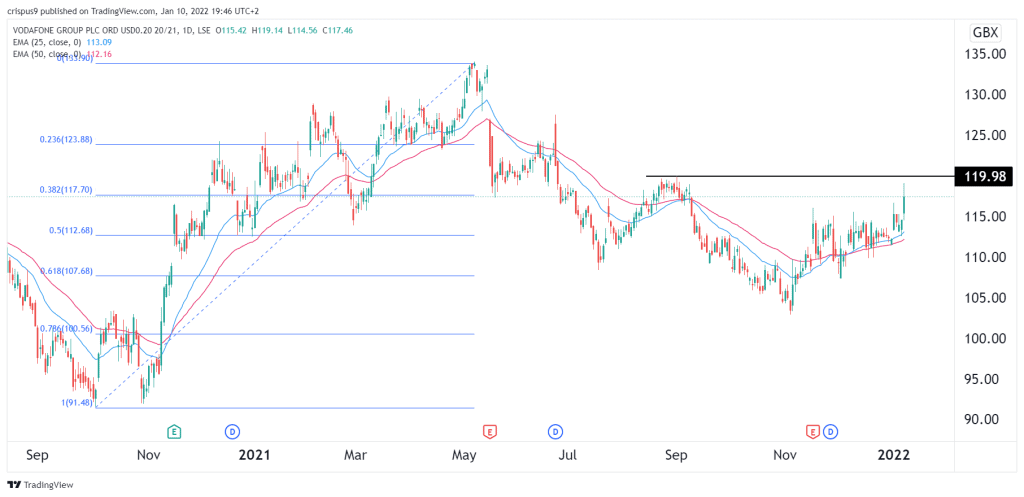

The four-hour chart shows that the VOD share price has done well in the past few weeks. Along the way, the stock formed an inverted head and shoulders pattern which is usually a bullish signal. The stock has moved above the 25-day and 50-day moving averages and is along the 38.2% Fibonacci retracement level.

Therefore, for now, the path of the least resistance for the Vodafone share price is to the upside. The next key level to watch will be the resistance at 125p. This view will be invalidated if the stock drops below 115p.