- VeChain price has been on the rise for the past one week, gaining almost 20 percent in the past week alone.

VeChain price has been on the rise for the past one week, gaining almost 20 percent in the past week alone. The cryptocurrency has also made a significant rise in today’s trading session, gaining more than 5 percent of its value.

Before diving into VeChain price analysis, we have to look at VeChain past price action and how it is likely to impact the analysis. VeChain began an aggressive bearish move on November 9, 2021. Since then, the cryptocurrency has lost more than 70 percent compared to today’s trading prices. The price action also shows that cryptocurrency is a very volatile asset class. However, this volatility has not been reflected in the current bull market of the crypto, a sign that there is still a possibility that the current gains are retracements rather than trade reversals.

VeChain Price Prediction

VeChain price is on a long-term bullish move. Although moving with little volatility, the cryptocurrency prices have been trading along an ascending trendline. Today, the prices are trading at $0.053, a 34 percent decline from what VeChain was trading at the start of the year.

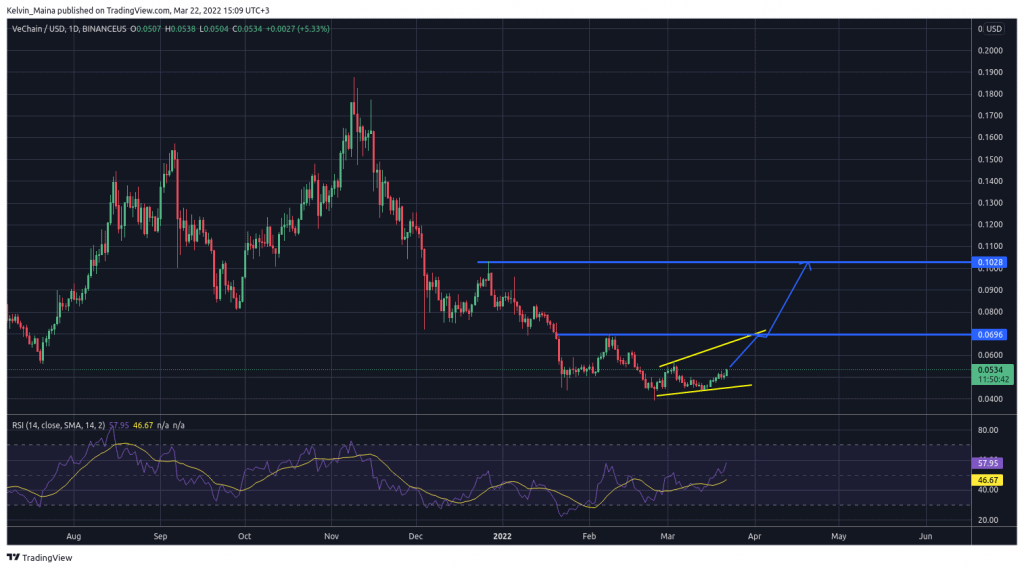

Looking at the daily chart below, it looks highly likely that the prices will continue with their upward trend. There is also a high likelihood that the prices will gain volatility in the coming days and hasten the bullish push. Therefore, my VeChain price prediction is a strong bullish move that will see the prices hit the $0.069 resistance level. In the chart below, I have also indicated a possibility of the prices rising to hit the $0.1 price level. This will highly depend on the volatility of the bullish move.

However, if the prices reverse and move towards the ascending trendline at any point, my trade analysis will be invalidated. It will also mean that the prices are still in a long-term bearish move. Finally, it will also indicate that the prices are likely to drop and form new yearly lows.

VeChain Daily Chart