The USDJPY pair rose in overnight trading as traders reflected on the Federal Reserve and Bank of Japan interest rate decisions. The pair is trading at 105.08, which is a few pips above the yesterday’s low of 104.78.

The Fed and BOJ concluded their meetings overnight. In the closely-watched meeting, the Federal Reserve left interest rate and the quantitative easing policies unchanged. That was in line with what analysts were expecting. At the same time, the dot plot by Fed officials showed that most officials expect to leave the rates unchanged at least until 2023. That was in line with what a survey by CNBC found. As a result of the Fed decision, the US dollar soared against most currencies.

The USDJPY also reacted to the BOJ interest rate decision. As was widely expected, the central bank decided to leave interest rates unchanged at -0.10%. That was in line with what analysts were expecting. Also, it left the quantitative easing and yield curve control policies intact.

Yield curve control is a situation where the bank sets a target for longer yields of treasuries and buys as much assets as possible. Most importantly, the bank upgraded the recovery of the Japanese economy. It expects the economy to rebound at a faster rate than previously expected.

This was the first rate decision under the new Yoshihide Suga administration. Suga was unanimously voted by the Japan’s parliament as the next successor to Shinzo Abe.

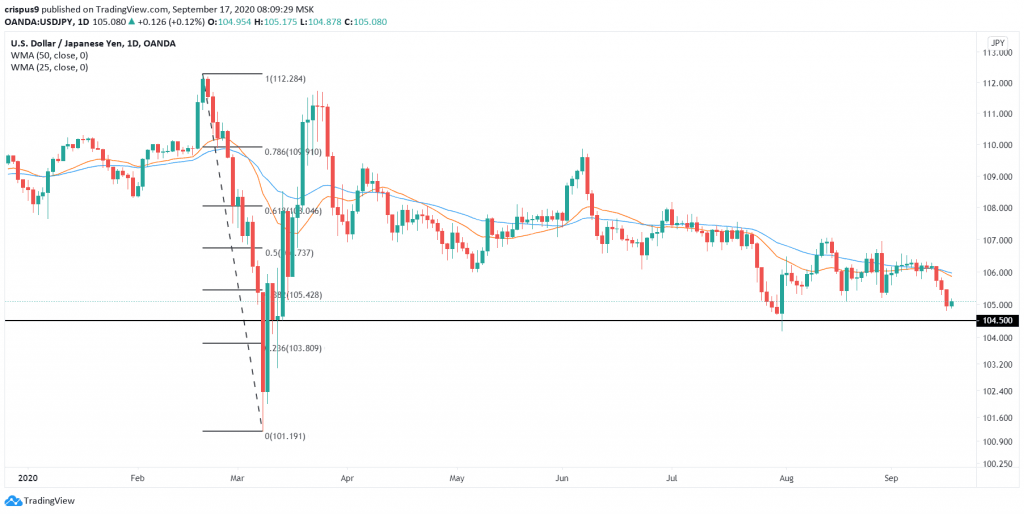

USDJPY technical outlook

The USDJPY declined to an intraday low of 104.78 after the FOMC decision. Today, the pair has pared back some of those losses and is trading at 105.08. On the daily chart, we see that the price is at the psychologically-important level of 105.00. It is also a few pips below the 38.2% Fibonacci retracement level.

This Fibonacci connects the lowest and highest levels this year. It is also a few pips below the 50-day and 100-day weighted moving averages. Therefore, I suspect that the pair will resume the downward trend as bears attempt to target the next support at 104.50.

Don’t miss a beat! Follow us on Telegram and Twitter.

USD/JPY technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.