- The Bank of Japan has intervened twice in the market, but the USDJPY pair has returned to the upside in under a week. What next?

As the USDJPY stays on course for a third successive day of gains, it is becoming apparent that the recent interventions by the Bank of Japan (BoJ) have done little to save the yen from further losses. The USDJPY pair traded at 155.59, having gained 0.58 percent in the intraday session at the time of writing. The yen now stares at the possibility of running into stronger headwinds driven by the perception that the dollar will likely surmount interventions by the BoJ as Japan’s macroeconomic fundamentals remain unfavourable.

The BoJ has intervened twice, with the initial effect being the success at bringing the exchange rate from a historic high of 160.20 to lows of 151.85 within a three-day period. However, the dollar has recovered almost half of the losses it incurred in as many days. This has cemented many analysts’ position that the pair is likely to retest the all-time highs if the BoJ does not intervene.

BoJ chief Kazuo Ueda has indicated that the bank will likely intervene in the coming days, stating that foreign exchange rates had an impact on both economic growth and inflation rate, which couldn’t be ignored.

Japan’s Finance Minister Shuni’chi Suzuki issued a verbal intervention on Wednesday, but his comments are unlikely to achieve much in a market where monetary action has achieved little. US Treasury Janet Yellen, on her part, commented that interventions should be “rare” and even potentially accompanied by consultations. This has raised the stakes for the yen, as it exposes its vulnerability in a larger scale than seen in recent times.

Looking ahead, the US will release its Initial Jobless claims figures, while Japan will release the Household Spending data for April on Thursday, which will be a key indicator of inflation. These are likely to bring new volatility into the USDJPY market.

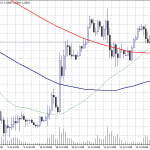

Technical analysis

The momentum on USDJPY signals that the buyers are in control. The upside is likely to continue if the buyers keep the price stays above 155.14. That will likely be met by resistance at 155.70. However, a continuation of control by buyers could push the pair to test 156.19. Conversely, if the pair breaks below 155.14, it will likely find support at 154.75. Furthermore, the pair could head lower below the first support and invalidate the upside narrative. In addition, such a momentum could see the pair test 154.25 in extension.