USDJPY is under selling pressure today after news that President Trump was holding up a trade deal with China and had no interest in moving ahead unless Beijing agrees again to four or five “major points” that Trump did not specify. The USD price dynamics will continue to drive the pair’s momentum as traders focus shifts to FED next move. Investors today waiting the US Consumer Price Index (CPI) data for the month of May scheduled at 12:30GMT that will affect the USDJPY intraday price. As of writing the pair is trading at 108.25 very close to daily low (108.21) and making new weekly low.

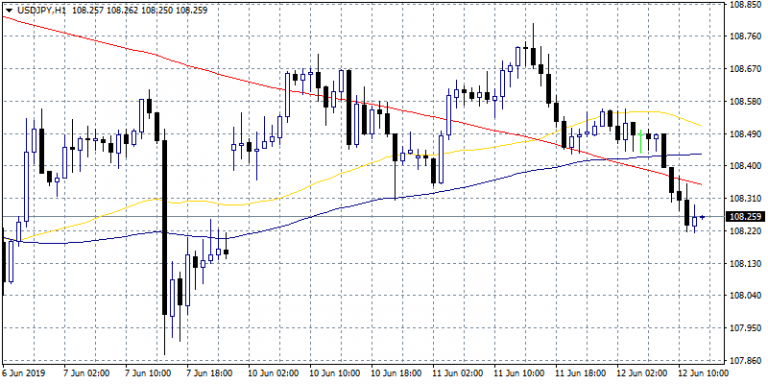

JPY is recovering this week as investor fears about an escalation in the US – China trade war resurface and turn their attention to safe heaven assets, like Yen and Gold. The pair broke below the key 200 and 100 hour moving (the red and blue line in our USDJPY hourly chart) and now the bears are in control. Immediate support for the pair stands at 108.00 round figure while extra support will be met at yearly low down to 107.60. On the upside first resistance stands at 108.43 the 100 hour moving average while a break above can drive prices up to 108.71 the high from yesterday. The Bearish momentum is still intact and any strong upticks for the pair should considered as selling opportunity.