- The USD/TRY price moved sideways on Tuesday as investors focused on the extremely divergent Federal Reserve and CBRT

The USD/TRY price moved sideways on Tuesday as investors focused on the extremely divergent Federal Reserve and Central Bank of the Republic of Turkey (CBRT). The pair is trading at 18.18, which is a few points below its all-time high. Other currency pairs like the GBP/TRY and EUR/TRY have also soared.

Fed and CBRT divergence

The USD to TRY exchange rate has been in a bullish trend in the past few months because of the growing divergence between the Fed and the CBRT. In his statement at the Jackson Hole Symposium in Wyoming, Jerome Powell warned that the Fed was not done hiking interest rates yet. He also said that the bank will maintain rates high for a while.

The Fed has been criticized for the current state of the economy. Indeed, some analysts believe that the bank is making a mistake by hiking too fast since the current inflation is because of supply-side dynamics due to the crisis in Ukraine.

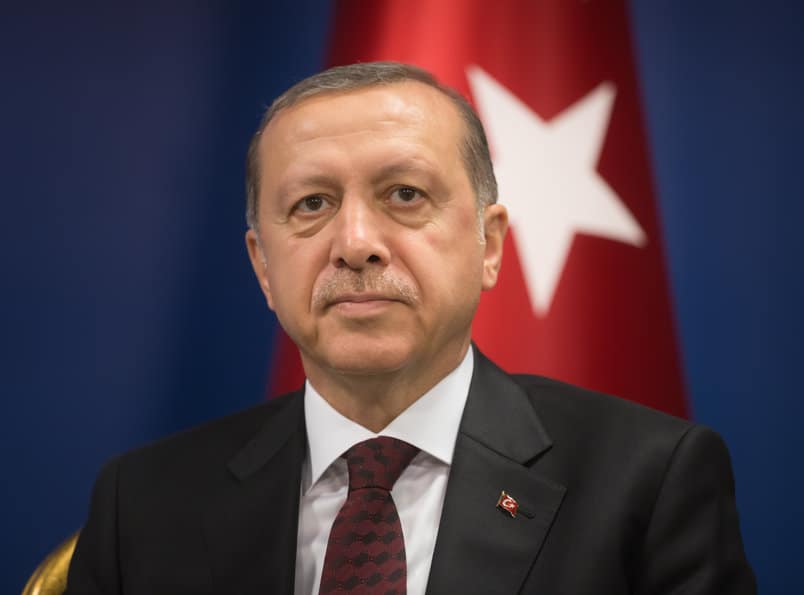

This view has been shared by the CBRT, which has embraced a more dovish tone. As a result, the bank decided to slash interest rates by 100 basis points this month. It argued that the rate cut was necessary, considering that the economy is showing signs of slowing down.

The next key catalyst for the USD/TRY price will be the upcoming US consumer confidence data by the Conference Board. Economists expect the data to show that the country’s confidence improved modestly in August as inflation retreated. The pair will also react to the upcoming US jobs numbers.

USD/TRY forecast

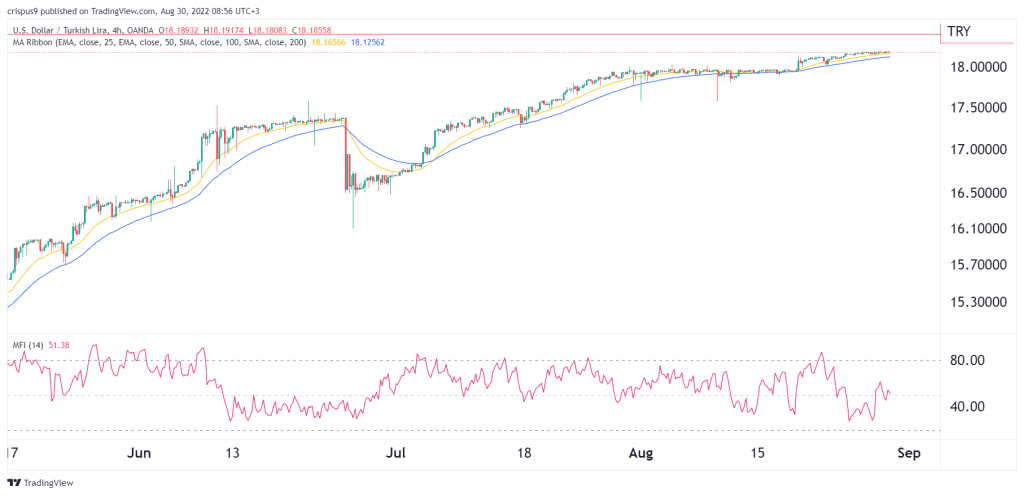

The four-hour chart shows that the USD to Try exchange rate has been in a strong bullish trend in the past few months because of the dovish tone of the CBRT. It rose to a high of 18.18 and moved slightly above the 25-day and 50-day moving averages. In addition, the Relative Strength Index (RSI) moved slightly above the neutral point at 50.

Therefore, the pair will likely continue rising as bulls target the next key psychological level at 19. A drop below the support at 17.9 will invalidate the bullish view.