- The USD/TRY has climbed to 5-week highs as positive US data provide support for the greenback ahead of next week's CBRT decision.

The USD/TRY has climbed to 5-week highs after Thursday’s upbeat macroeconomic data provided a push for the greenback. Rising bond yields have also taken out potential carry trade plays on the pair, sending the USD/TRY above the 8.6000 mark.

Next week, the Central Bank of the Republic of Turkey presents its interest rate decision. The End of Year CPI Forecast came in at 16.74%, above the previous number of 16.30%. The CBRT is expected to leave its one-week repo rate unchanged at 19.00%. However, there are some bets on the bank easing rates much sooner than anticipated, especially as the CBRT plans to use the core inflation figure as the benchmark for its interest rate decisions and not the headline figure.

USD/TRY Technical Outlook

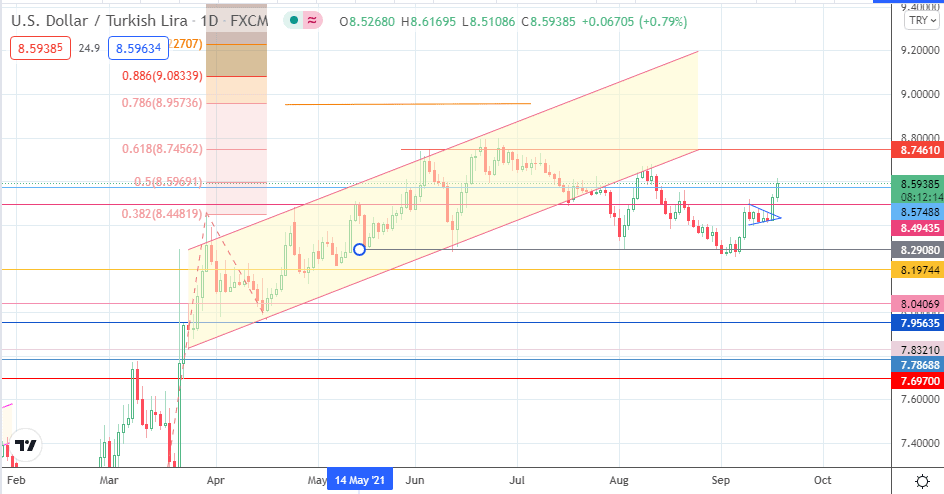

The intraday violation of 8.57488 needs a 3% penetration close above that level for the advance to continue towards 8.74610. Above this level, 8.80000 remains the all-time high level to beat. If the pair breaks past this level, a potential new target lies at the 78.6% Fibonacci extension at 8.95736.

On the flip side, the bears would find some joy if the price declines below 8.29080. This move would clear the pathway towards 8.19744 and potentially, 8.04069. Such a decline is contingent upon the price failing to clear 8.57488, with a pullback move taking out 8.49435.

USD/TRY: Daily Chart

Follow Eno on Twitter.