- The USD/TRY spikes above 11.00 as the CBRT cuts interest rates in Turkey by 100Bps despite soaring inflation.

The USD/TRY has made a clean break of the 11.00 mark after the Central Bank of the Republic of Turkey (CBRT) cut the interest rates in the country by 100 basis points as widely expected.

The CBRT cut the one-week repo rate by 16.00% to 15.00%. It also lowered the overnight borrowing rate from 14.5% to 13.5% and the overnight lending rate from 17.50% to 16.50%. The CBRT also says it is looking to assess Turkey’s monetary situation to determine if the rate-cutting cycle could end by December 2021.

The Turkish Lira weakened significantly on the decision, which many market watchers consider to be baffling in the face of inflation which has topped 20% in Turkey.

Year-to-date, the Lira has fallen 30% under the weight of COVID-19-related headwinds and the central bank actions, which have largely been due to pressure from President Recep Erdogan. Erdogan has replaced the governors of the CBRT four times in the last 30 months.

The USD/TRY touched new all-time highs at 11.3531 before retreating slightly. It is up 4.45% as of writing.

Technical Outlook: USD/TRY

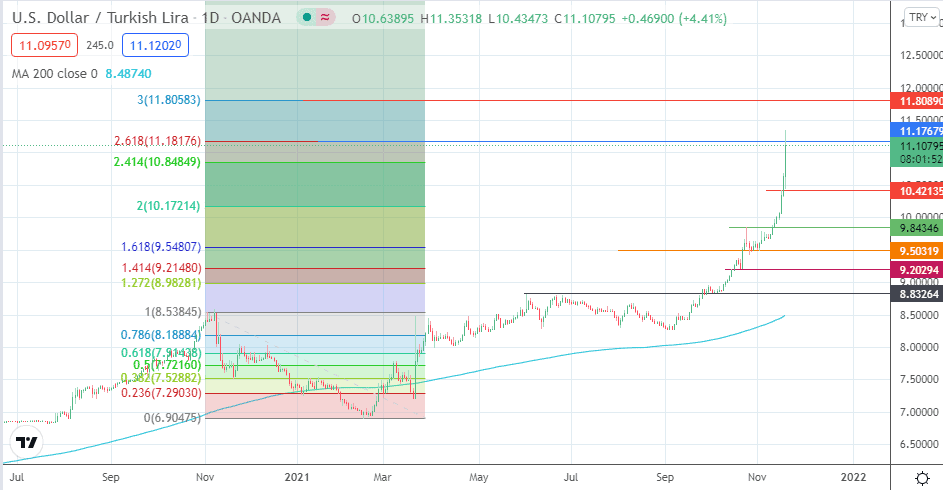

The weekly chart indicates that the present price level is touching the 261.8% Fibonacci extension level of the retracing price swing from 3 November 2020 to 19 February 2021. A break of this level opens the door to new highs, possibly at 11.80890.

On the other hand, a corrective decline targets 10.4213, before the 9.84346 support (25 October 2021 high) comes into the picture as a medium-term downside target.

USD/TRY: Weekly Chart

Follow Eno on Twitter.