- The USD/TRY price surged to the highest level since December amid a severe divergence between the Federal Reserve and CBRT

The USD/TRY price surged to the highest level since December amid a severe divergence between the Federal Reserve and the Central Bank of the Republic of Turkey (CBRT). The USD to TRY pair jumped to a high of 17.35, which is about 70% above the YTD low. Other similar pairs like the GBP/TRY and EUR/TRY have also surged.

Turkish lira crash continues

The USD to TRY exchange rate soared as the Fed and the CBRT moved in different directions. The Fed has already hiked interest rates by 150 basis points in 2021 as it continues battling soaring inflation. It has also hinted that it will continue rising interest rates in the coming months. Analysts expect another jumbo rate hike of 0.75% later this month.

On the other hand, the CBRT has embraced a more dovish tone this year. It has maintained interest rates at 14% even as inflation has surged. Data published earlier this month showed that the Turkish inflation rate soared to over 78%, which it has been in the past few decades.

The next key catalyst for the USD/TRY pair will be the upcoming US inflation data scheduled for Wednesday this week. Economists expect the data to show that the country’s inflation surged to 8.8%, which will be the highest level in more than decades. Therefore, with the American labor market tightening, analysts expect that the Fed will keep hiking interest rates in the near term.

In a statement on Monday, Fed’s Raphael Bostic said that the bank will likely hike by 0.75%. He said: “Right now I’m pretty comfortable. I’m confident that the economy will be able to withstand this next move. I would support a 75 basis-point” increase.”

Meanwhile, the actions by the Turkish central bank to cushion the Turkish lira have not worked. In 2021, the Turkish government announced that it will compensate lira holders for inflation. And most recently, it said that it will block companies that hold vast foreign currencies from taking loans.

USD/TRY forecast

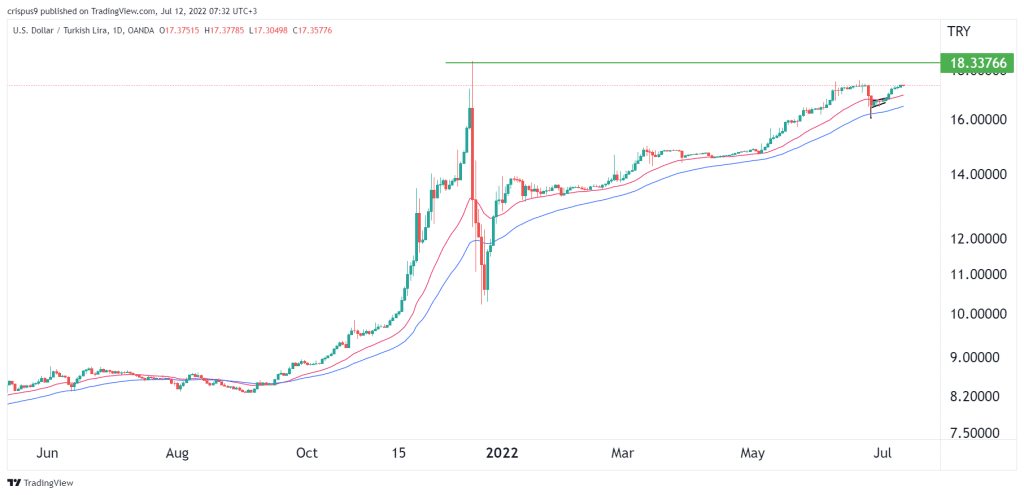

The daily chart shows that the USD to TRY continued rising in the past few months. The pair rose to a high of 17.35, which was the highest level since June. It has moved above the 25-day and 50-day moving averages. It has moved slightly below the important resistance level at 18.33, which was the highest level since December 2021,

Therefore, there is a likelihood that the USDTRY pair will keep rising as the Turkish lira collapse continued. If this happens, the next key resistance to watch will be at 18.33. A drop below the support at 16.85 will invalidate the bullish view.