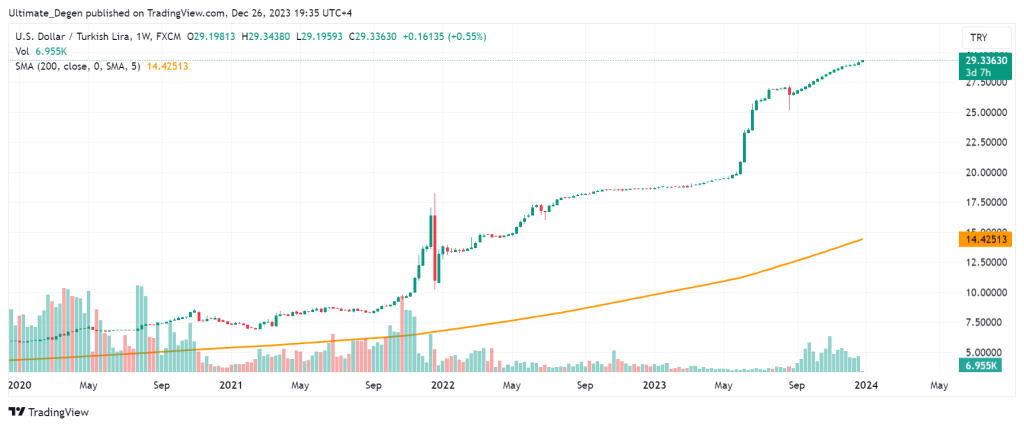

- Turkish Lira Outlook: USD/TRY is up for the 18th consecutive week in a row. The trend will likely continue in the coming months.

USD/TRY has been a massive disappointment this year. Turkish Lira has lost 57% of its value against the dollar since the start of 2023, and the trend doesn’t seem to be stopping anytime soon. For the past 17 weeks, the dollar lira exchange rate has been in a never-ending uptrend, and it is on track to close another week in green.

This weakness in Turkish currency could be attributed to the record inflation and the investors ditching Lira-based investment products for the greenback. To be honest I am not surprised by the recent price action of USDTRY as I forecasted this demise months ago.

I remember mentioning the potential target of 30 for TRY/USD when the pair was trading just above 20. It’s as if there’s no limit to the devaluation of the Lira, as it has shrugged off aggressive rate hikes and other unprecedented measures by the Turkish central bank.

There is no point in doing any technical analysis on the above-mentioned chart as the pair is trading more than 100% above its 200-day moving average, which is very rare for any currency pair.

After seven consecutive rate hikes by the Turkish central bank, the interest rates in the country have now hit 40%. Nevertheless, the USD/TRY forecast is still looking very bullish as the pair keeps making new highs every day.

The latest rate hike occurred last week as the central bank raised interest rates by another 250bps.