The consumer price index (annualized) rose 15.9% in June, lower than the consensus number and down from 17.1% in May, according to the Russian Federal Statistics Service. Data released on Friday indicated that Russian inflation rose by its lowest figure since February 2022, when its conflict with Ukraine began. Analysts had expected the figure to come in at 16%. The lower print caused a drop in the USD/RUB, which fell 6.00% on Friday.

Capital controls and a drop in consumer spending took the heat off consumer prices. In addition, the foreign exchange substitution policy Russia initiated for buyers of its energy products has brought in needed foreign exchange, easing pressures on the local currency. As a result, the Russian Central Bank has downgraded its baseline inflation outlook and sees consumer prices rising from 14% to 17% by the year’s end. The apex bank meets in two weeks to decide on the new interest rates going forward.

This Monday, the USD/RUB has gained 2.47% in the last four hours as a stronger dollar and lower crude oil prices push back on the Ruble’s recent gains. The uptick comes as the Russian Central Bank mulls an intervention to weaken the currency, according to chatter from top Russian officials.

USD/RUB Outlook

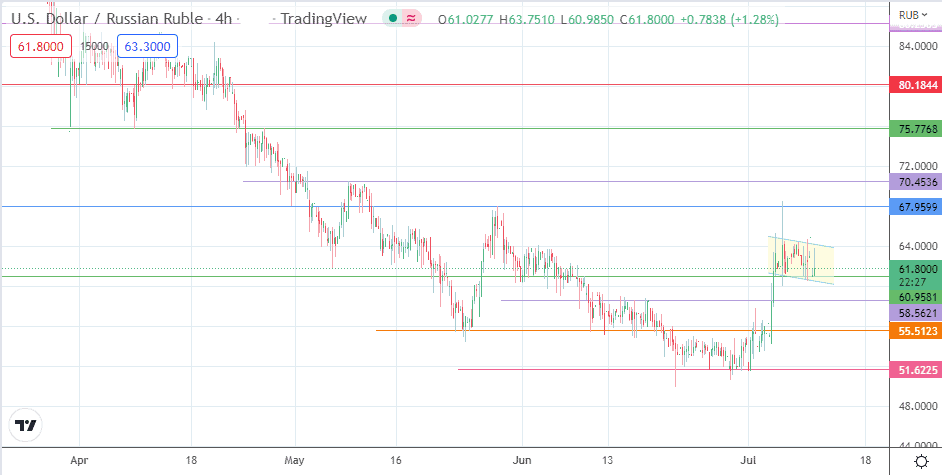

The emerging bullish flag on the 4-hour Chart indicates a potential move to the price barrier seen at the 70.4536 resistance level. This is the site of the completion point of a measured move from the breakout point at 64.00, where the flag’s upper border is found. This move must stem from a bounce on the 60.9581 support (8 July low), breaching the 67.9599 resistance (27 May and 6 July highs) along the way. Additional targets to the north come in at 75.7768 (27 April high) and 80.1844, the site of the 3 April low and 22 April high.

The pattern is invalidated if the bears break down the current support at 60.9581. This scenario sees 58.5621 (16 June high) and 55.5123 (21 June high) forming the immediate downside targets. Further price deterioration allows the bears to aim for the 51.6225 price mark, where the 26 June and 1 July lows take up residence.

USD/RUB: 4-hour Chart