Following Tuesday’s late rally that helped the greenback recover from its earlier losses against the Yen, the USD/JPY is experiencing choppy movement, resulting in a doji candle in Wednesday’s session.

Coming on the back of four days of steep losses, the USD/JPY seemed certain to end Tuesday’s trading as a 5th consecutive day in negative territory. However, some late Fedspeak and recovery of the US 10-year bond yields by 6.73% enabled the pair to bounce back and end the session 1.18% in the green.

On Tuesday, heads of the regional Fed Reserve banks in Cleveland, San Francisco, St. Louis, and Chicago hit the newswires, all lending support to an unrestrained tightening of monetary policy. Reuters quoted notable hawk James Bullard, who heads the St.Louis Federal Reserve bank, as saying that interest rates in the United States would need to remain higher for longer if inflation did not recede. He opined that the Fed would need to “go a little bit higher than what I said before” in lending support to the aggressive rate hike route by the apex bank.

Additional fundamental triggers for the USD/JPY this week are the ISM Services PMI data due this Wednesday and Friday’s Non-Farm Payrolls report, in which the market expects some cooling in US public sector hiring.

USD/JPY Forecast

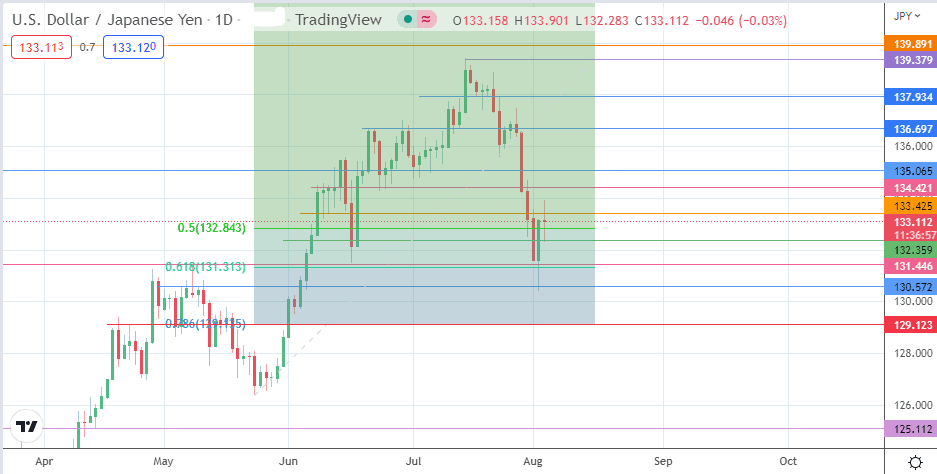

The 24 May to 14 July price action swing has served up the relevant Fibonacci retracement levels. The daily chart shows that the price action bounced off the 130.572 price mark, the site of the 6 June low and closed just above the 61.8% Fibonacci retracement level at 131.446 (the previous low of 16 June). Further price advance was rejected at the 133.425 resistance (10 June low and 1 August high), around which the active daily candle has formed a doji.

The bears would be seeking a further downside push from this level to retest the 132.359 support (current intraday low), with 131.446 and 130.572 serving as the immediate downside targets now acting in role reversal. The 78.6% Fibonacci retracement level at 129.135 provides another level of support, coinciding with the previous high of 22 April 2022.

On the flip side, the bulls need to force a break of 133.42 to create a path toward the 135.065 resistance target (6 July low). Additional targets to the north are seen at 136.697 (21 June high) and at 137.934 (22 July 2022 high). The 139.379 resistance formed by the previous high of 14 July is only accessible if the bulls achieve clearance of the 137.934 barrier.

USD/JPY: Daily Chart