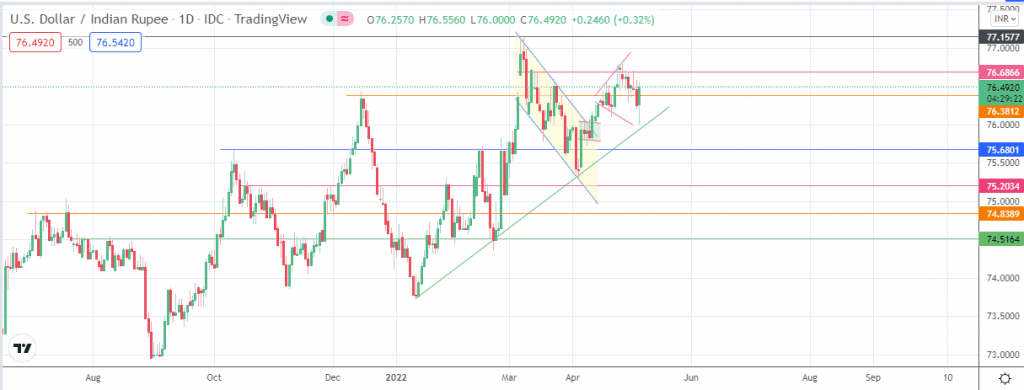

The USD/INR pair dipped heavily earlier in the session before recovering in the New York session above the 76.38 support level. This preserves the integrity of this support and keeps the megaphone top pattern still in evolution.

Before the big moves seen on Wednesday and Thursday, the pair traded in a narrow range as the markets awaited the Fed interest rate decision. The 50bps rate hike was within market expectations and had largely been discounted by the market, resulting in traders selling the fact after buying the rumours previously.

Selling continued on Thursday before new bids came in at the key support level formed by the megaphone top’s lower border and the ascending trendline. The USD/INR pair is expected to remain in demand ahead of Friday’s Non-farm Payrolls report. The expectation is for job additions in the public sector (minus agriculture) to have eased from 430K in March to 391K in April. The unemployment rate is also expected to drop from 3.6% to 3.5%.

USD/INR Outlook

The intraday bounce on the intersection of the lower border of the megaphone top and the ascending trendline has pushed the pair above the 76.3812 resistance. Above this level, the 76.6866 resistance level (15 March and 3 May highs) and the 77.1577 barrier constitute the additional targets to the north. This outlook invalidates the megaphone top pattern.

On the flip side, the bears would be seeking a breakdown of the ascending trendline and the megaphone top’s lower border to pursue a measured move that targets the 75.2034 support line (28 January and 17 February highs in role reversal). To attain completion, this measured move needs to take out the 75.6801 support (31 March 2022 low). Further targets to the south rest at 74.8389 (1 November and 1 December 2021 highs) and at 74.5164 (6 October 2021 and 31 January 2022 lows).

USDINR: Daily Chart

Follow Eno on Twitter.