- The USD/INR looks on course to hit new record highs this week as rising crude oil prices take a toll on the Rupee.

The USD/INR is trading higher, notching up gains of 0.28% this Monday as traders prepare for the Reserve Bank of India (RBI) Monetary Policy Committee meeting and interest rate decision on Wednesday, 8 June 2022.

The pair has seen a surge in the last two trading days, even as the markets are expecting an upward adjustment of rates by 40bps from the current levels of 4.40%. The Reverse Repo rate is expected to remain steady at 3.35%, while the Cash Reserve Ratio is also expected to remain static at 4.50%.

The primary driver of the surge in the USD/INR has been a combination of rising oil prices from the Ukraine conflict, and interest rate policy divergence between the Fed (which has raised rates twice) and the RBI, which has kept rates steady. If the RBI raises rates by 40bps, this will be considered a relatively insignificant step considering that the Fed has already hiked by 75bps and will likely do more before 2022 is over.

Moreover, rising oil prices and flight to safety over the Ukraine conflict favours the greenback over the Rupee, the world’s third-largest oil importer’s currency. The RBI’s decision is likely to impact the pair in the near term, but geopolitics and an ever divergent rate policy outlook will remain the medium-term drivers of price action on this pair.

USDINR Outlook

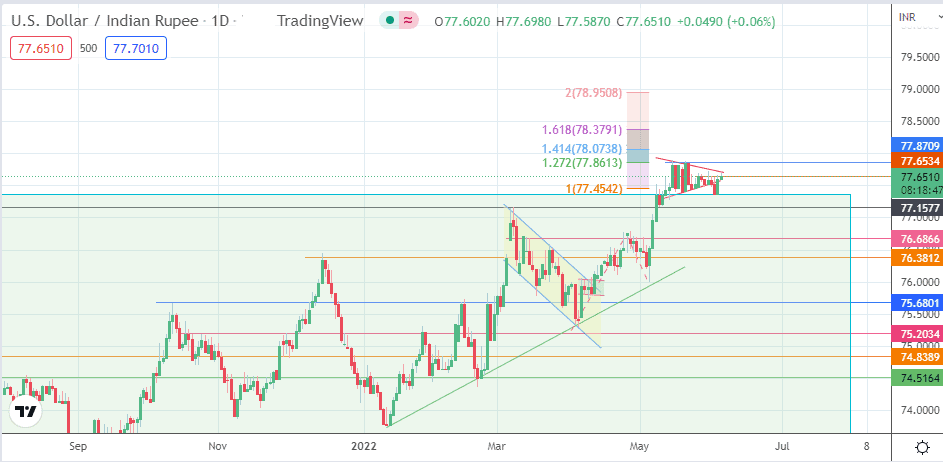

The violation of the 77.6534 resistance requires confirmation via a 3% penetration close above this barrier. If confirmed, the pathway toward the 77.8709 resistance becomes clear. The pair hits new record highs only when this barrier is broken, targeting the 77.8613 price mark (127.2% Fibonacci extension level from the 5 April swing low to the 26 April swing high).

Potential targets above this point include 78.0738 and 78.3791 (161.8% Fibonacci extension). These are expected to come into the picture before the 79.00 psychological price mark, where the completion point of the measured move from the bullish flag lies.

On the flip side, rejection at 77.8709 could lead to a corrective decline, retesting 77.6534 and 77.1577 (10 May low). If the correction extends below the latter, 76.6866 and 76.3812 could become additional targets to the south. 76.3812 is where the ascending trendline touches off the horizontal support.

USD/INR: Daily Chart