- The US dollar index (DXY) is tilting lower ahead of the latest US consumer confidence and jobs data. What next?

The US dollar index (DXY) is tilting lower ahead of the latest US consumer confidence and jobs data. The index is trading at $96.13, which is about 0.80% below the highest level this month. It is still about 3% above its lowest level this month.

The DXY index had a relatively strong November as investors embraced a risk-off sentiment. In the past few days, however, the index has retreated as investors react to the new omicron variant. Later today, the index will react to the latest consumer confidence data by the Conference Board. Analysts expect the data to show that confidence dropped from 113 in October to 111 in November as inflation concerns remain.

On Wednesday, the dollar index will react to the latest ADP private payrolls data. Analysts expect the data to show that the country’s private sector added 520k jobs in November. This will be a worse number than the previous 571k.

On Thursday, the US will publish the closely-watched jobless claims numbers. Last week, the data showed that the country’s initial claims declined to the lowest level in more than 50 years. Therefore, the market will watch at the progress.

Finally, the dollar index will react to the latest US non-farm payrolls scheduled on Friday. The numbers are expected to show that the NFPs rose in November as the unemployment rate retreated.

US dollar index forecast

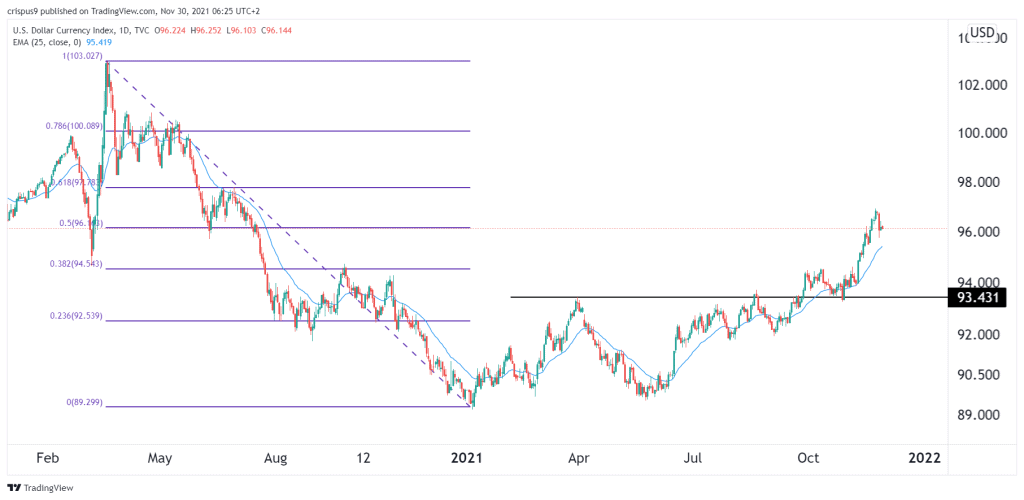

The daily chart shows that the DXY index was in a bullish trend in November. Along the way, it managed to cross the important 50% Fibonacci retracement level. It also moved slightly above the 25-day and 50-day moving averages. It also rose above $93.43, which was the neckline of the inverted head and shoulders pattern.

Therefore, the pair will likely keep rising in December as investors target the 61.8% retracement level at $97.8. This view will be invalidated if the dollar index drops below $95.