- The Dow Jones index recovered all of Tuesday's losses after getting a boost from upbeat factory orders and services PMI data.

The Dow Jones index is trading higher this Wednesday, but the upside move appears limited as the markets appear to be waiting for direction from Friday’s jobs data.

The Dow Jones index fell 369 points on Tuesday after long-term bond yields rose 6.7%, driving investment flows from the US stock market. Hawkish comments from St. Louis Fed Chairman and member of the FOMC board James Bullard reinvigorated expectations of an aggressive rate hike trajectory, further dampening the sentiment on the Dow.

However, the Dow Jones index has recovered all of Tuesday’s losses after the ISM Services PMI rose from 55.3 to 56.7 in July 2022, beating market estimates of 53.5. Factory orders also rose from 1.8% (an upward revision) to 2.0%, better than the estimates of a 1.3% growth. These data keep the Dow positive ahead of the NFP report. Traders are also watching the geopolitical events in Asia very closely, which has served to cap the day’s gains.

The Dow Jones index is up 1.05% as of writing.

Dow Jones Index Forecast

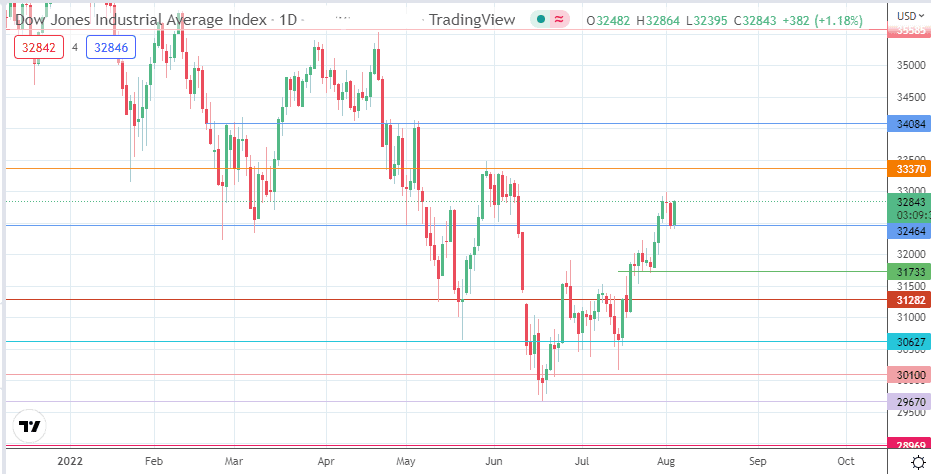

The breakout from the 32464 resistance met resistance at 33000 on Monday. Following the doji candle and the correction of Tuesday, the price bounced on the 32464 resistance-turned-support level, truncating the evening star pattern and keeping the bulls on course to target the 33370 resistance target. Above this level, the 34084 resistance formed by the previous highs of 28 April and 4 May 2022 lines up as an additional target to the north.

On the flip side, a decline below the 32464 support level allows for a descent toward the 32000 psychological support level (28 July low). Below this level, additional support comes in at the 22/26 July 2022 lows found at 31733. 31282 and 30627 are additional price targets to the south, located at the 5 July 2022 high and 20 May low, respectively. A potential pitstop is found at 3100, the site of psychological support and the 19 July low.

Dow Jones: Daily Chart