- Uniswap price prediction of $12.5 would remain on the cards as long as the price holds $6.60 level. UNI price is retesting 200-day MA.

Our Uniswap price prediction is still bullish, but the prevailing uncertainty regarding CPI numbers has increased the volatility. Most cryptocurrencies, including UNI crypto, have been trading at the lowest levels since the start of the week. After a good start to the week, the UNI price is 6.48% down today.

Uniswap has shown one of the biggest recoveries in major altcoins. After tagging the low of $3.35 in June, the coin surged to $9.83 in July. However, this 200% rally was stalled by the rejection of the BTC price from the $24.5k level.

At the time of writing, Uniswap price is trading at $8.24. The coin is still 144% up from its June lows. However, on the higher timeframe, UNI is 82% down from its May 2021 all-time high of $45. The volatility is likely to continue this week till the release of the CPI report. Therefore, it is better to sit on the side-line if you’re not in any trade. You may trade Uniswap by signing up on Binance.

According to Uniswap news today, the community of the top DEX has proposed the creation of the Uniswap Foundation. The proposal, which was put forth by Devin Walsh and Ken Ng, has sought a budget of $74 million to set up an independent entity.

Uniswap Price Prediction

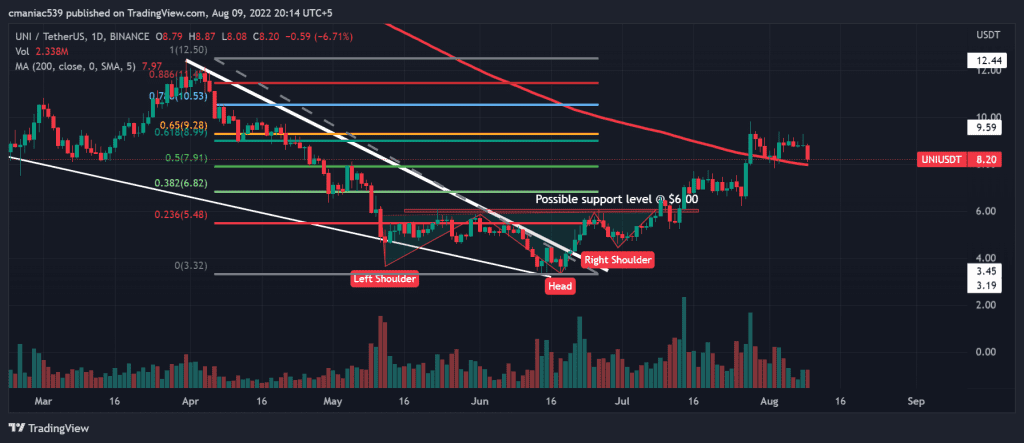

Technical analysis of the UNI USD price chart shows a clear breakout from the falling wedge pattern. A significant increase followed this breakout in volume, which validated the breakout. Falling wedges are bullish patterns with breakout targets at the top of the wedge. Therefore, the price target of $12.5 is still on the cards.

Uniswap price prediction of $12.5 would remain on the cards as long as the price holds the $6.60 level. A daily closure below this level would invalidate this price analysis. Another factor affecting the price is the Bitcoin price action. This week’s BTC price action would be very critical for the altcoin price action in the rest of August.

Uniswap Daily Chart