- We look at UMA price prediction in the wake of a massive single-day rise of a third. What's behind the move and what's in store?

UMA price continued its upsurge on Thursday, gaining 2.42 percent to trade at $3.53 at the time of writing. That was a follow-up to Wednesday’s massive spike of 33%, which included an intraday high of $4.22, the highest level since March 31. Prior to Wednesday’s spike, the token had been trading sideways after the much-hyped Oval announcement turned out to be nothing more than a Maximal extractable value (MEV) protocol.

The coin is likely to gain more usage as the DeFi ecosystem rises and as the demand for smart contract-focused solutions rises. UMA stores derivatives on the blockchain, and in exchange for collateral, it mints a token representing the asset (known as a synthetic asset). The smart contract then specifies the terms and incentivizes its adherence via incentives. Also, UMA is a governance token that users can use to vote on proposals and stake their holdings.

On Wednesday, UMA protocol announced that Gitcoin DAO had integrated oSnap, the protocol’s tool for securing on-chain transactions based on off-chain voting decisions. Gitcoin is a fast-growing decentralised funding platform that enables open-source developers to earn when their work is used. Following the integration, Gitcoin DAO will use oSnap to distribute treasury payments. oSnap’s total value has risen significantly and stands at $689 million as of this writing, signaling oSnap’s growing influence in the DAO ecosystem. Furthermore, the integration will bring down transaction costs significantly and make the governance process more seamless.

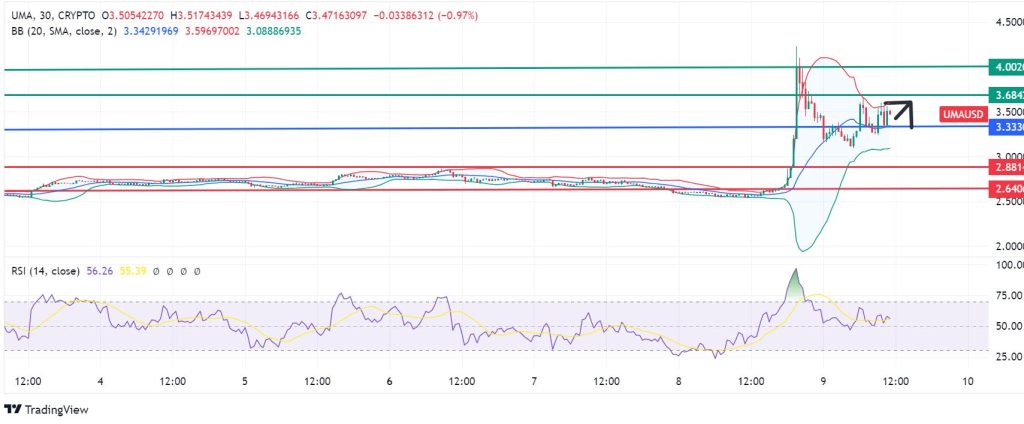

Technical analysis

My UMA price prediction shows that the momentum currently favours the buyers, and the UMAUSD pair pivots at 3.333. If the buyers manage to keep the price above that level, then they are likely to break the resistance at 3.638, and potentially build the momentum to head to 4.00 in extension. Alternatively, moving below the pivot will signal control by the sellers, with the first support likely to come at 2.881. At that point, extended control by the sellers will likely break the support. Furthermore, the resulting momentum will invalidate the upside narrative and instead pull down the price further to test 2.640.