- The THG share price meltdown has accelerated as investors worry about the company’s future amid a tightening environment.

The THG share price meltdown has accelerated as investors worry about the company’s future amid a tightening environment. The Hut Group share price is trading at an all-time low of 119p, which is about 85% below the all-time high. Its total market cap has crashed below 1.5 billion pounds.

THG is not the only major UK tech company that has sold off lately. For example, the Deliveroo share price has slumped even after the company published a strong guidance. Similarly, the Wise share price has crashed by over 40% from its all-time high as fintech stocks crumble. Other fast-growing tech shares that have fallen are Asos, Boohoo, and DarkTrace among others.

There are several reasons why THG share price has collapsed. First, the company was attacked by a short-seller who accused the company’s operating model. Second, The Hut Group surprised investors last week when it slashed its forward guidance because of the rising commodity prices and forex issues.

Third, analysts are generally pessimistic about the company. The most recent extremely bearish analyst was from Citigroup, who downgraded its EBITDA to about 176 million pounds. Finally, the company is one of the most shorted stocks in London.

THG share price forecast

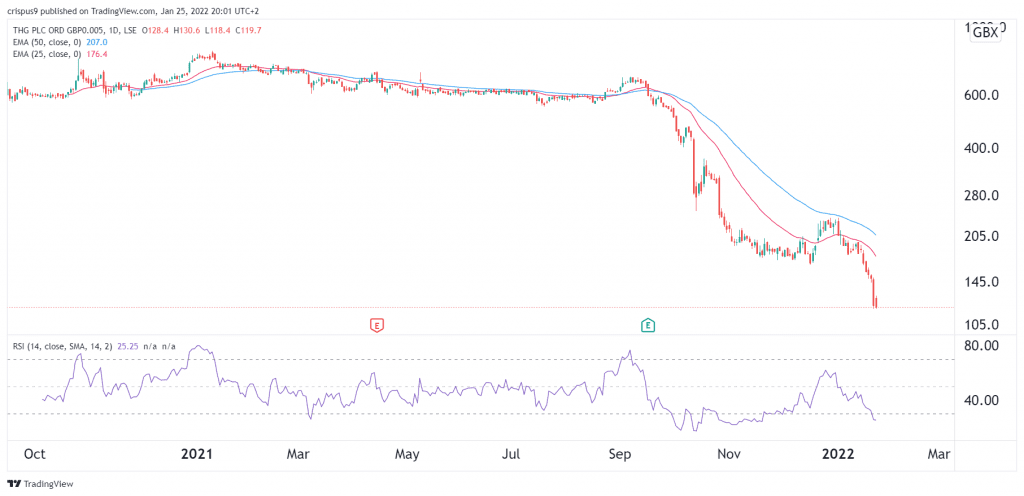

The daily chart shows that The THG share price has been in a strong bearish trend in the past few months. Along the way, the stock has dropped below the 25-day and 50-day exponential moving averages (EMA). It is also below the Ichimoku cloud while the Relative Strength Index has moved to the oversold level.

Therefore, in my view, I suspect that the shares have more downward room to go especially now that the Bank of England and the Fed have embraced a hawkish tone. This means that it could drop to about 90p. In the long-term, however, the stock will likely bounce back as investors embrace the new normal.