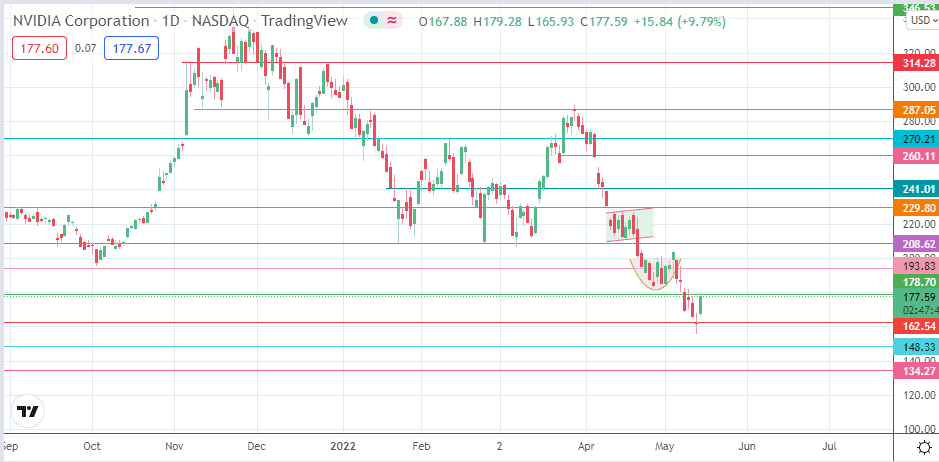

- The 178.70 resistance must give way for the Nvidia share price to advance towards the $208 barrier on the back of the morning star pattern.

The Nvidia share price has staged a strong rebound this Friday, posting a 9.93% uptick on the day. This comes after the stock had fallen more than 15% this week, as risk-sensitive tech stocks responded negatively to the Fed’s 50bps hike last week Wednesday. That rate hike was the first time in 20 years the Fed had raised rates by half a percentage point, and the selloff that hit wiped off $85billion from the Nvidia share price‘s valuation.

Higher-than-expected inflation data provided a platform for a continuation of the selloff. A $7.7m fine from the US Securities and Exchange Commission (SEC) for failure to disclose crypto mining profits in 2018 also added to the negative sentiment.

Long-term, the stock still has potential. The transition to cleaner vehicles and equipment will only lead to a higher demand for its semiconductors. This is reflected in the 12-month median price forecast by 41 institutional analysts, who see a median price target of 340.00. This is an upside potential of nearly double the current price. As shown in this Nvidia share price prediction, any dips could be potentially attractive buying opportunities.

Nvidia Share Price Outlook

The bullish daily candle completes the morning star formation. However, there must be a penetrating close above the 178.70 resistance (19 July 2021 low and 11 May 2022 high) to open the door for an additional advance towards 193.83 (18 June 2021 and 6 May 2022 highs).

Uncapping of this new resistance clears the path towards 208.62 (7 July 2021 high, 20 September 2021 and 8 March 2022 lows). Above this level, 229.80 (25 January and 15 March highs) and 241.01 (26 January and 23 February highs) form additional northbound targets.

On the flip side, rejection at the 178.70 price mark truncates the bullish expectation of the morning star pattern. This also opens the door for a decline towards 162.54 (15 April 2021 and 28 May 2021 highs in role reversal). Further price deterioration prints a path to new support at 148.33 (23 April 2021 low), before 134.27 becomes another target to the south on a continued decline.

Nvidia: Daily Chart