- The Hut Group share price has careened recently. We explain whether now is a good time to buy the THG stock and what to expect.

The Hut Group share price has moved into a consolidation phase as investors worry about the company’s future. THG shares are trading at 103.70p, which is about 45% above the lowest point in 2021. Like most tech companies, it has had a strong fall from grace considering that the stock was trading at 838p in January 20211.

THG, formerly known as The Hut Group, is a company that operates in four key industries. Its biggest segment is its Beauty Group, which generated over 1.1 billion in revenue in 2021. This division includes brands like LookFantastic and Grow Gorgeous. It is followed by the Nutrition business which generated over 659 million pounds. The biggest product in this division is MyProtein.

THG also has a large business known as Ingenuity, which generated over 194 million in 2021. This division sells tech solutions to other companies in the consumer business. It now manages about 187 websites. THG has its OnDemand solution and Other businesses, which brought in about 200 million pounds. In total, the company managed to grow its total revenue from 1.6 billion in 2020 to over 2.17 billion in 2021.

The main concern among investors is that the company’s growth is slowing. However, there are signs that investors have pushed the stock to extremely cheap valuations. The firm has a market cap of 1.27 billion, which is about 1.7x 2021 sales.

Therefore, since the company has already received multiple buyout offers, there is a possibility that others will start circling. However, the risk is that they will be repelled by the slowing annual and quarterly growth rate and the fact that it is yet to break even.

The Hut Group share price forecast

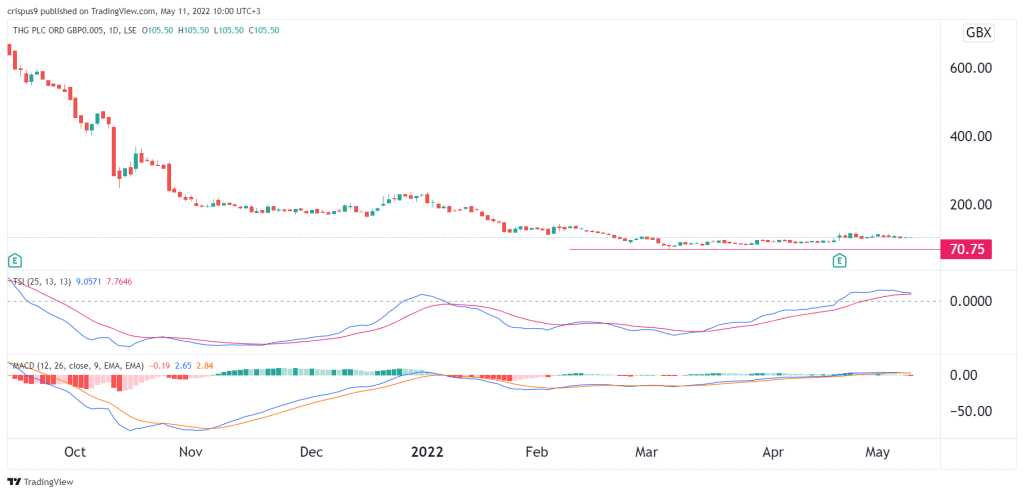

THG stock price has been dead money for a while now as you can see in the daily chart below. The shares have not mapped a bullish or bearish trend as investors wait for a catalyst. The True Strength Indicator has crossed the middle line while the MACD has moved to the neutral point.

Therefore, at this point, technicals suggest that the Hut Group share price will remain in this range as investors continue waiting for the next catalyst. The key support and resistance point will be at 95p and 115p.