- The EURUSD is under pressure after strong US labour market, real estate and manufacturing data built on Fed interest rate decision.

The US dollar extended its gains against the euro on Friday, with the EURUSD pair declining by 0.40% to trade at 1.0816 at the time of writing. The US dollar is riding on a blend of upbeat economic data and the Fed’s latest interest rate decision to attract buyers. Meanwhile, the euro’s PMI data provide support to the euro, delaying a slide to month-to-date lows.

The Eurozone’s preliminary manufacturing PMI reading for March dented the euro’s strength, after falling 1.3 percentage points below the forecast figure to come in at 45.7. This affected the composite PMI, which read 52.9, missing the forecast 53.1. However, the services PMI rose from February’s 49.2 to 49.9, beating the forecast estimate of 49.7.

Nonetheless, EURUSD’s upside was neutralized by stronger US economic figures. The initial jobless claims read 210k, faring better than the forecast 212k. Meanwhile, the reading for the week ending March 7 was revised upwards from 209k to 212k. More downward pressure came from the S&P Global US Manufacturing PMI, which beat the forecast 51.8 to reach 52.5. Existing Home Sales also beat the consensus figures, after rising by 9.5% in February to reach 4.38 million, versus the projected 3.95 million.

Meanwhile, yields on benchmark 10-year US Treasury bonds have stayed above 4.230% for the third consecutive day, and this will continue attracting safe haven buying. Federal Reserve Chairman Jerome Powell is slated to speak at the opening of the New York session, and this could bring fresh impetus to EURUSD.

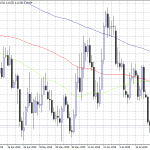

Technical analysis

The momentum on EURUSD is currently bearish, and the downside will prevail as long as resistance remains at the 1.0855 pivot level. With the sellers in control, the pair could head below the 1.0790 support and potentially test 1.0770 in extension. The trend could, however, change if the buyers push the price above 1.0855. That could build the momentum to overcome the resistance at 1.0875 and target 1.0895.