- Telcoin price prediction 2022 indicates that there are prospects of some recovery, but the future remains clouded from competition.

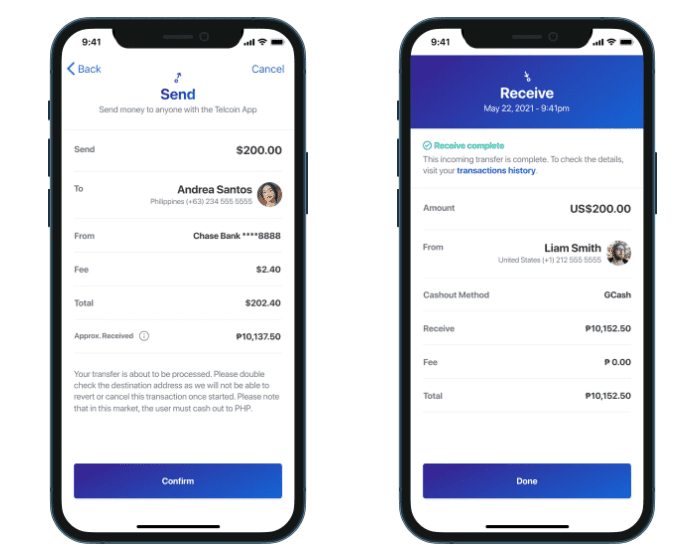

Telcoin is a fintech company that utilizes the blockchain to deliver financial products worldwide. The project was initially conceptualized as a means to use telecoms to provide financial services to the unbanked regions of the world. However, that model has been modified and expanded with the advent of decentralized finance on the blockchain. As a result, the project has been rebranded as a remittance-based business that relies on the power of the blockchain to deliver decentralized financial products and services not just to the unbanked but to every mobile phone user in the world.

Telcoin price prediction has partnered with telecoms operators and mobile money platforms to this end. The foundation of its service is the Telcoin platform and the Telcoin app.

Table of contents

Telcoin Founders

Paul Neuner, a cybersecurity and telecoms entrepreneur, is the co-founder of Telcoin. He started the company in 2017 along with Claude Eguienta, who now works as the CEO of Mimo. Paul Neuner remains the company’s CEO.

Telcoin Road Map

Telcoin held its initial coin offering (ICO) in 2017. Telcoin concluded this offer as the crypto market was about to enter a bear market. Between 2017 and 2020, the Telcoin team was on a journey of silent development for the project, raising funds, bringing in critical people, and working on its applications.

TEL liquidity mining on Uniswap came on board in August 2020, and Telcoin joined Balancer in September 2020.

October – December 2020 saw several new releases. The beta phase of Telcoin v2 hit the public domain in October 2020, along with the first corridor public beta release in the Philippines. In November 2020, the KYC module was released, and Telcoin App V2.1 hit the App Store.

The same month saw the coming of the 2nd receiving market. December 2020 brought in the 2nd sending market, the 3rd receiving market, and the first fiat-TEL on-ramp functionality.

The Winter Roadmap 2021 (Jan-Mar) saw the integration of the Telcoin App v2.2 with the remittance feature. In addition, the 3rd sending/4th receiving markets and the 2nd fiat-TEL on-ramp came onstream. Single market test marketing campaigns also kicked off.

The rest of 2021 featured the addition of more sending and receiving markets, the launch of Telcoin App v3.0 (project Rivendell), and more fiat-TEL on/off ramps. By December, Telcoin app v3.2 was ready, and the company started to scale up its marketing campaigns.

Telcoin’s Adoption Statistics

TEL tokens are mined via a proof-of-work consensus algorithm. However, this will change to the more energy-efficient Proof-of-Stake (PoS) algorithm once the 1,000th block has been mined. Telcoin was created with a supply cap of 100,000,000,000 TEL tokens. More than 50% of these tokens are in circulation. Currently, it is possible to send money to 16 countries using the Telcoin App and counting.

Telcoin Price Prediction 2022

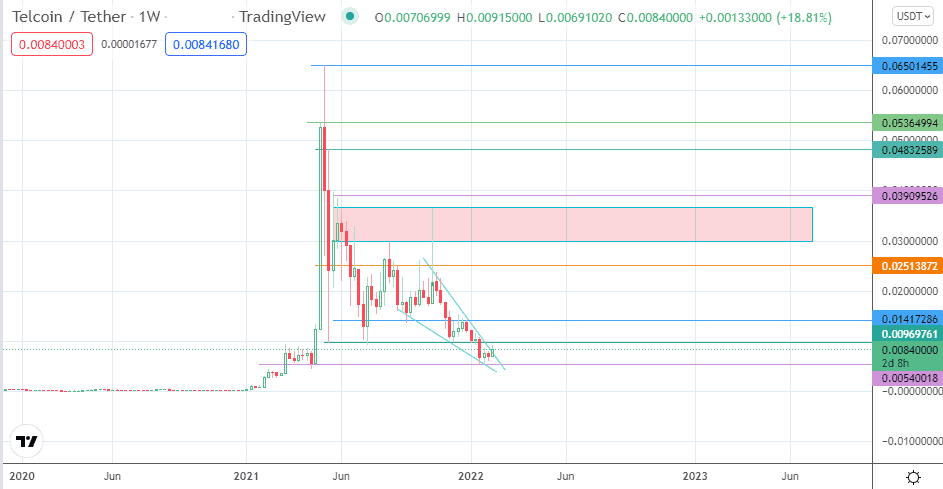

The Telcoin price prediction 2022 is a medium-term outlook for the TEL/USDT pair and focuses on the picture on the weekly chart.

The price picture indicates that the TEL/USDT pair is range-bound, trading between 0.00969761 and 0.00540018. The latter corresponds to the 22 March 2021 low and serves as the point of intersection for the lower boundary of the falling wedge pattern.

The active weekly candle has violated the upper boundary of this wedge, but the breakout is only deemed complete if there is a closing penetration above the 0.00845071 resistance. This opens the door for the bulls to push towards 0.01417286. This is the initial target before 0.02513872 emerges as the next barrier in line.

A rejection at 0.00842508 sets up a retest of 0.00540018, and a decline below this support invalidates the previous outlook. As a result, the Telcoin price prediction 2022 sees 0.02513872 as the potential resistance that caps any recovery attempts for the year, leaving this as the potential ceiling for the TEL/USDT in 2022 0.00540018 as the possible floor.

Telcoin Price Prediction 2025

The Telcoin price prediction for 2025 does not have a clear direction. Despite the potential of the company to ride on the expected wave of digital remittance growth, it is unclear if the company has done enough homework to beat out any competing projects for this market. Therefore, the Telcoin price prediction 2025 will depend on its market penetration and its ability to ramp up the number of users of its Telcoin App.

The company plans to delve into the decentralized exchange market and has set up a platform for this purpose (TELx). However, Telcoin needs to wrestle the market share of the DEX market from established players to lift its outlook going into 2025.

Is Telcoin a Good Investment?

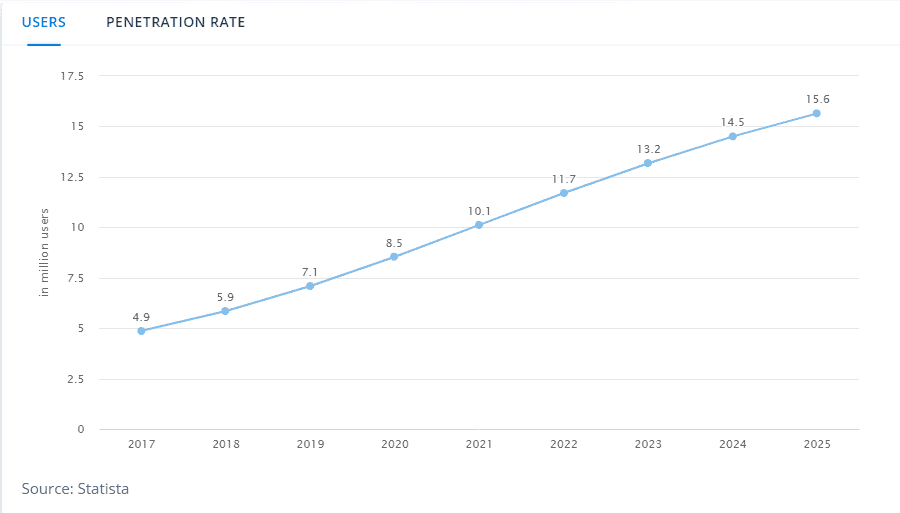

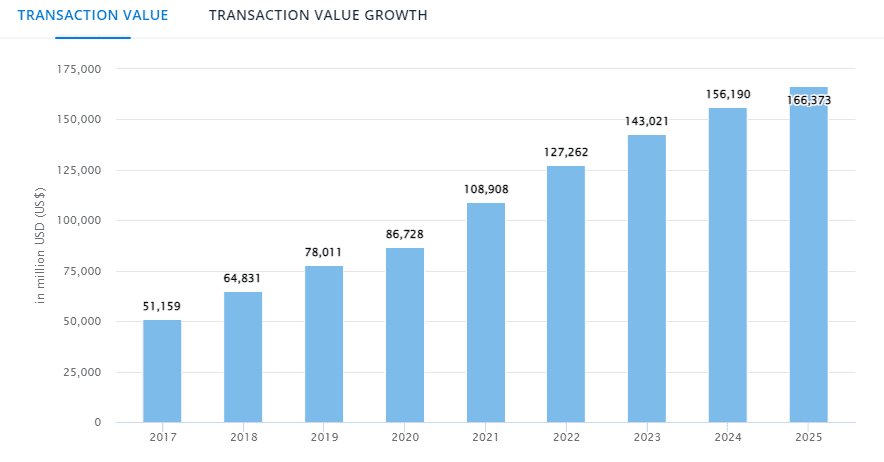

To understand the positioning of Telcoin in the digital remittance space and get an answer on whether Telcoin is a good investment, here are some data from Statista in this regard.

Digital remittances are expected to hit a transaction value of $127.6 billion in 2022, showing an annual growth rate of 9.34% between 2022 and 2025. This translates into a transaction value of $166 billion by 2025.

The number of digital remittance products users will hit 15.6m users by 2025. Average transaction values will hit $10,876 in 2022.

Several emerging market economies still have large swathes of unbanked people. For these, cross-border payments and money transfers represent an invaluable way of sending and receiving money across their borders. During the COVID-19 lockdowns in many countries, digital payments ramped up even as traditional banking institutions were forced to shut down branches due to the lockdowns. The banking industry saw a 94% drop in cross-border remittances in one African nation, while P2P payments in cryptos skyrocketed nearly 400%.

The ability of Telcoin to grab a significant portion of this market share remains instrumental in transforming it into a remittance powerhouse. If Telcoin can penetrate this market and increase usage of its remittance app in countries underserved by traditional banking institutions, then it will be a good investment. However, suppose the company fails to seize this opportunity and spends too much time growing its business in established markets. In that case, it may lose market share to competitors, present and emerging.

How to Buy Telcoin?

Telcoin was introduced into the Kucoin exchange for exchange trading in 2018. TEL/USDT, TEL/BTC, and TEL/ETH are the available pairs. The TEL/USDT pair is the most traded, with a 24-hour volume of $6.1m as writing. Telcoin can also be traded on Indodax (TEL/IDR), Balancer (Polygon as TEL/USDC), Uniswap V2 (TEL/WETH) and Bitrue as TEL/USDT.

These exchanges are the venues where you can buy Telcoin, and you can do so using stablecoins (USDT, USDC), Ethereum and Bitcoin.

TEL/USDT: Weekly Chart