- The TCS share price recovered slightly in July as investors attempt to buy the recent dip. Tata Consultancy shares are trading at INR 3,265

The TCS share price recovered slightly in July as investors attempt to buy the recent dip. Tata Consultancy Services shares are trading at INR 3,265, which is slightly above last week’s low of INR 3,028. This price is about 18% below the highest point this year. The most recent catalyst for the stock was the company’s quarterly earnings.

Tata Consultancy earnings

Tata Consultancy is one of the biggest companies in India. It has a market cap of over $150 billion, making it the second-biggest firm in the country after Reliance Industries. Also, it is the biggest part of the broader Tata Group, a conglomerate that includes companies like Tata Teleservices, Tata Motors, Tata Steel, Tata Consumer Services, and Tata Power.

TCS, as the company is commonly known, provides IT consulting services globally. It competes with the likes of Accenture, Wipro, IBM, and Cognizant Technologies. It provides its services to companies and governments around the world. Some of the consulting work it does includes analytics, blockchain, cyber security, and quality engineering.

The TCS share price has pulled back slightly as investors react to last week’s earnings. The firm said that its revenue rose by 16.2% year on year. In dollar terms, revenue surged by 10% to $6.7 billion while its net margin came in at 18%. The company managed t add 9 customers worth over $100 million.

These results imply that Tata Consultancy Services business is still doing well even as demand for IT spending slows. The earnings, which missed analysts’ estimates, came a few weeks after Infosys results missed estimates as well.

In a statement, the firm’s CEO said:

“Pipeline velocity and deal closures continue to be strong, but we remain vigilant given the macro-level uncertainties. Our new organization structure has settled in nicely, getting us closer to our clients and making us nimbler in a dynamic environment.”

TCS share price forecast

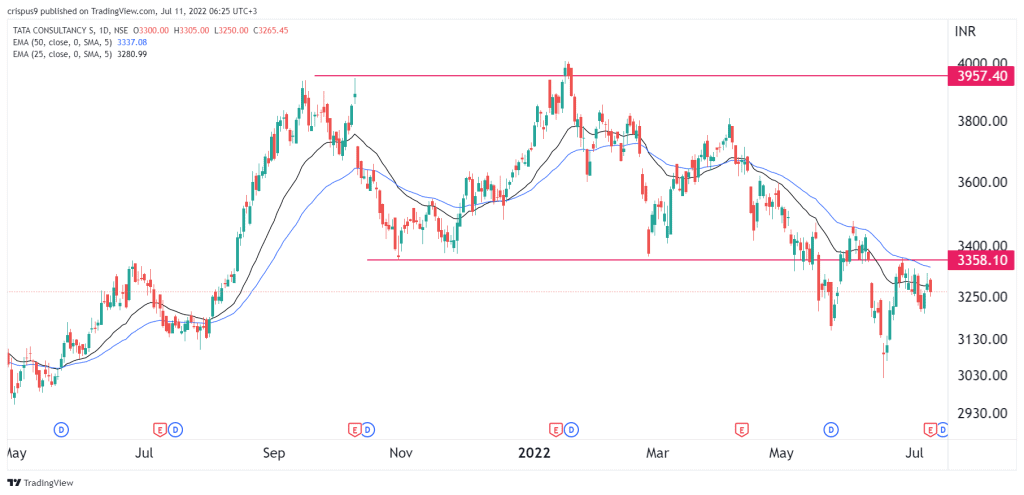

The daily chart shows that Tata Consultancy’s share price found a strong double-top close to its resistance at 4,0000 INR. In price action analysis, a double-top pattern is usually a bearish sign. The stock managed to move slightly below the chin of this pattern at 3,358 INR. It remains below the 25-day and 50-day moving averages.

Therefore, the TCS share price will likely resume the bearish trend as bears target the key support level at 3,100 INR. A move above the resistance at 3,358 INR will invalidate the bullish view.