- The Stellar Lumens price crawled back on Tuesday even as the latest data shows that the network activity is dropping.

The Stellar Lumens price crawled back on Tuesday even as the latest data shows that the network activity is dropping. The XLM token is trading at $0.1973, which is slightly above the year-to-date low of $0.1610. The coin’s market capitalization has moved to $4.9 billion, making it the 30th biggest coin in the world.

Stellar is one of the biggest blockchain platforms that is seeking to disrupt the vast money transfer industry. Companies in the industry can use its technology to provide solutions for remittances and cross-border payments. Central banks can also use the network to build central bank digital currencies (CBDCs).

Another key part of the Stellar ecosystem is the USD Coin (USDC) stablecoin that was built by Circle using its technology. The coin has a total market cap of more than $53 billion and os the 5th biggest coin in the world. Circle, its creator, is set to go public in a deal valuing the company at more than $15 billion.

However, in the past few weeks, on-chain data shows that the platform’s transaction growth is slowing. According to Messari, the real and adjusted volume has been slowing as shown in the chart below. The same is true with the average transfer value, which is sharply below its all-time high in 2021. Other metrics like total fees and transaction costs have also declined sharply.

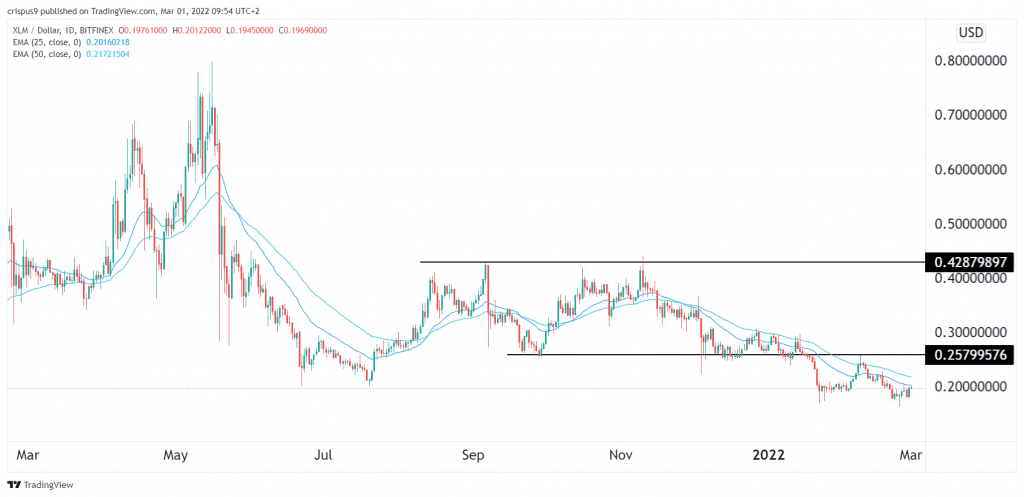

Stellar Lumens price prediction

The daily chart shows that the XLM price has been in a bearish trend and is currently hovering at its lowest level in July last year. It has crashed by more than 75% from its highest level in 2021. A closer look at the chart shows that the price is below the key resistance at $0.2580, which was the lowest level on September 28th. It has also moved below the 25-day and 50-day moving averages. Therefore, there is a likelihood that the bearish trend will continue as long as the price is below the two moving averages. The next key support to watch will be at $0.1500.