- The Invesco QQQ and SPY stock prices have done well this year. The two popular ETFs have jumped by more than 25% this year.

The Invesco QQQ and SPY stock prices have done well this year. The two popular ETFs have jumped by more than 25% this year. In the past five years, the QQQ stock price has surged by more than 240% while the SPY has jumped by more than 120%. Now, which is a better fund to buy as the Fed starts its hawkish policies?

QQQ vs SPY

Invesco QQQ is one of the biggest and most popular ETFs in the world today. QQQ has more than $205 billion in assets and a dividend yield of about 0.45%. It tracks the Nasdaq 100 index, which tracks the biggest tech companies in the United States.

The SPY ETF, tracks the S&P 500 index and has more than $424 billion in assets and has a dividend yield of about 1.22%. The biggest companies in the ETF are all tech firms like Apple, Microsoft, and Google. Still, unlike the QQQ fund, it is more diverse and has more sectors like finance, energy, and consumer discretionary.

The SPY fund has jumped sharply this year because of several reasons. First, financial stocks like Goldman Sachs and Morgan Stanley have done well as investors wait for the upcoming rate hikes. At the same time, energy stocks have risen sharply because of the rising oil and gas prices.

Still, looking forward, there is a likelihood that the QQQ will outperform the SPY fund. For one, most tech firms in the index are not exposed to the ongoing supply shortages. For example, Microsoft’s exposure to these issues is relatively minimal.

At the same time, many stocks in the fund are relatively cheaper. For example, Apple has dropped by about 5% from its year-to-date high. Other companies like Tesla, Square, and PayPal have also pulled back recently. Therefore, there is a possibility that the stocks will bounce back.

Also, investors have already priced in tightening by the Fed. As such, there is a likelihood that financial stocks will pull back in the coming months.

QQQ stock analysis

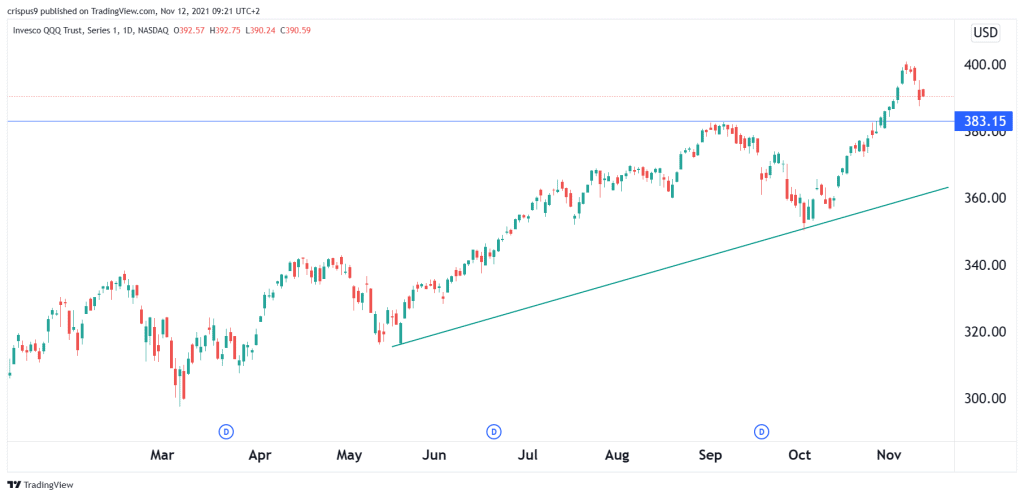

The daily chart shows that the QQQ stock price has pulled back recently. The fund is trading at $390, which is a bit lower than its all-time high. It is also slightly above the important support at $383, which was the highest level on September 7. The fund seems like it is doing a break-and-retest pattern, which is a bullish sign.

Therefore, the fund will likely retest the support at $383 and then resume the bullish trend. This view will be invalidated if it moves below $350.