- The S&P 500 index could open higher this Thursday after US producer inflation fell in July in a surprise move.

After a 2.13% uptick in yesterday’s trading following data that showed a cooling of US consumer inflation, the S&P 500 index could open higher after other numbers provided by the US Bureau of Labor Statistics indicated an easing of inflationary pressures on US producers.

The second day of gains looks to be on the cards as the S&P 500 index futures are up 0.5% following a drop in the producer price index by 0.5%, well below the consensus of a rise by 0.2% and far short of June’s 1.1% increase. In addition, core PPI (PPI excluding food and energy prices) rose 0.2% monthly, two percentage points lower than the previous and consensus numbers.

Many stocks on the S&P 500 index have regained a lot of the year’s losses in the past few weeks.

A historical look at the S&P 500 index also shows that market demand returned once inflation numbers were perceived to have peaked.

The slowing of producer inflation further cuts the odds of a 75 bps rate hike by the Fed in September’s meeting, with the market odds of a 50 bps rate hike rising from 60% to 70%. The S&P 500 index and other US markets should benefit from the situation, but a slight increase in initial jobless claims from 248K to 262K could moderate any upside market impact.

S&P 500 Index Outlook

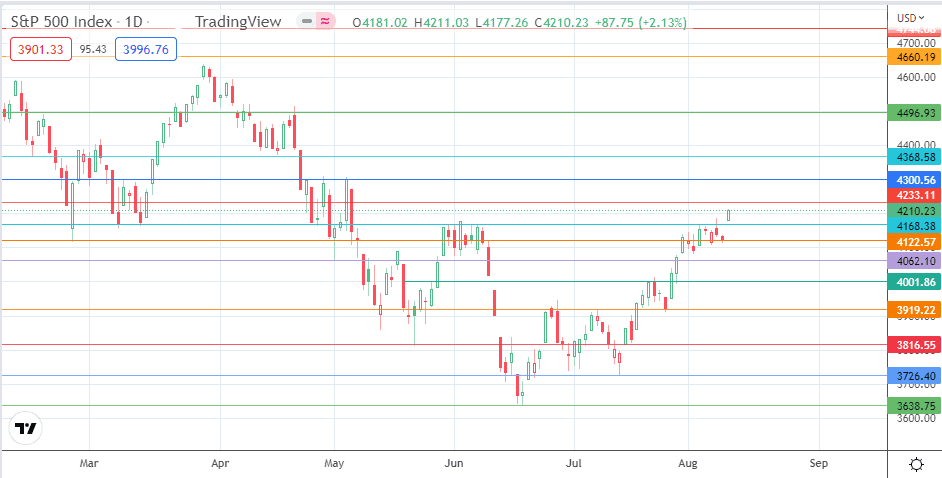

The strong gains of Wednesday put the S&P 500 index on course to target the 4233 resistance, which stands between the bulls and the 4300 psychological price point and the site of previous highs of 9 March. 25 April and 4 May 2022. Above this level, additional upside barriers are seen at 4368 (14 February and 18 May lows) and 4496 (23 March high).

On the flip side, a retracement must take out the 9 June high/9 August low at 4122 to make way for the bears to gain access to 4062 (). The 4000 psychological pivot (25 May high and 28 July low) and the 3919 support (26 July low) form additional southbound targets.

SP500: Daily Chart