- The first NFP report for 2022 shows that there is high potential for the Fed to start raising rates in March 2022. The SP 500 falls...

The SP 500 index is in negative territory this Friday after the jobs numbers for December indicated that there is now potential for rate hikes by the Fed in 2022.

The US economy added 199K public sector jobs (426K consensus), with the unemployment rate falling from 4.2% to 3.9% (4.1% consensus). Average hourly earnings rose from 0.4% (revised upwards) in November 2021 to 0.6% in December 2021, pointing to the fact that as more Americans walk off their jobs, companies are paying more to attract the skilled ones still in the workforce.

The combination of a reduced unemployment rate and wage inflation has raised bets of at least three rate hikes in 2022, with the first coming as early as March 2022. San Francisco Fed President Mary Daly said in a panel discussion at the American Economic Association’s annual meeting that the Fed was now at a point where it “definitely need to adjust policy”.

The SP 500 is down 0.23% as of writing on Friday.

SP 500 Outlook

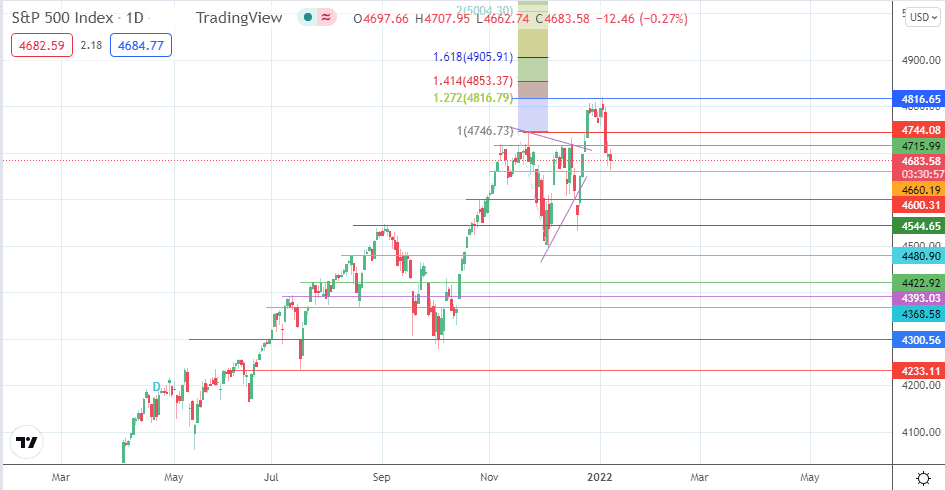

Friday’s decline has put the bears within touching distance of the 4660 support. A breakdown of this level opens the door towards 4600, with 4544 and 4480 serving as the additional targets to the south.

On the flip side, a bounce on the 4660 support makes room for a potential climb towards 4715, before 4744 and 4816 enter the picture as additional upside targets. With the sentiment of the market now reflecting hawkish Fed action, any rallies may become new opportunities to initiate short positions.

SP 500 Index: Daily Chart