- Rising US long term bond yields are sending the S&P 500 Index lower, along with expectations of renewed hawkishness by the Fed.

The S&P 500 index has lost ground on Friday after US consumer confidence climbed from 70.3 to 71.0, but failed to beat market expectations of 71.9. The number exposed the S&P 500 to the prevalent fundamentals of the day, the rising US long-term bond yields.

Yields on the 10-year US Treasury Note climbed for the 3rd day in a row, trading at 2.17% higher as of writing. Rising yields are causing a diversion of capital from US stocks to the bond market, keeping the S&P 500 index range-bound between 4480 and 4422.

Heightened expectations of renewed hawkishness by the Fed in its 22 September meeting is also driving down the index, which has benefitted immensely from the Fed’s QE program and low-interest-rate environment.

The S&P 500 index is down 0.9% as of writing, putting the index on course for a second week of losses.

S&P 500 Outlook

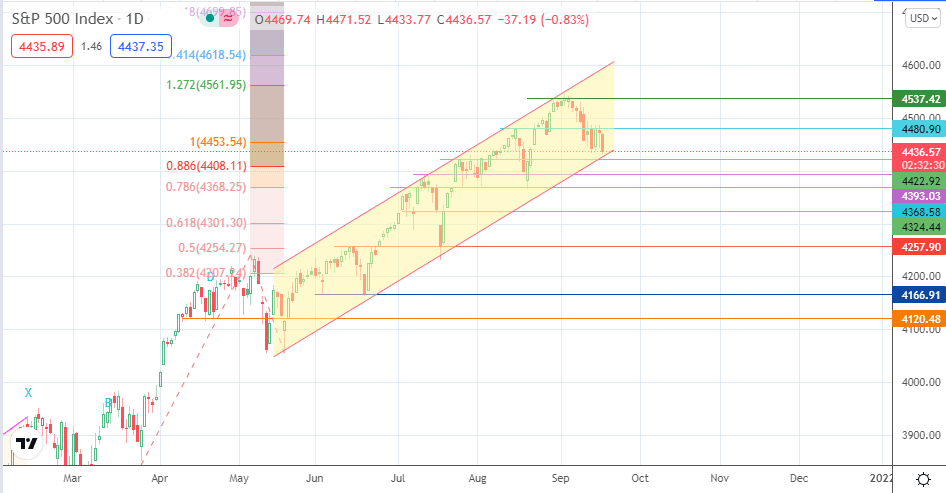

Price looks set to test the support at 4422.92. A breakdown of this price level targets 4393.03, with 4368.58 and 4324.44 lining up as additional downside targets.

On the other hand, a bounce off 4422.92 and the channel’s lower boundary allow for an upward leg toward 4480.90. This barrier needs to give way for bulls to attack the 4537.42 resistance. If the advance continues, all-time highs beckon with 4561.95 and 4618.54 in the running as potential upside targets.

S&P 500 Index: Daily Chart

Follow Eno on Twitter.