The S&P 500 index has opened higher after softer-than-expected US Consumer Price index data hit the newswires an hour ago. According to the US Bureau of Labor Statistics, core consumer inflation (m/m) rose by 0.3%, representing a 4-percentage point drop from the previous figure.

It also rose by less than the 0.5% the markets had expected. The headline number, which incorporates food and energy prices in its calculation, was flat in July. This represents a 13-percentage point drop from the June number. It was also a lower-than-expected print, as economists had predicted a rise of 0.2%.

On an annualized basis, US CPI rose 8.5%, lower than the market consensus of 8.7%. This represents a drop from the previous reading of 9.1% for June but remains far beyond the Fed’s 2% target. Core inflation remains at 5.9% (consensus 6.1%). The data set has halved the previous market expectation of a 75bps rate hike in September, leaving this at a probability ratio of 1/3.

The data show that the rate hikes implemented by the Federal Reserve in response to spiraling inflation appear to be working, negating the need for more aggressive action when the US apex bank meets in September 2022. This is a US-market-positive situation and is reflected in the S&P 500 index, which has opened 1.75% higher following the news release.

S&P 500 Index Forecast

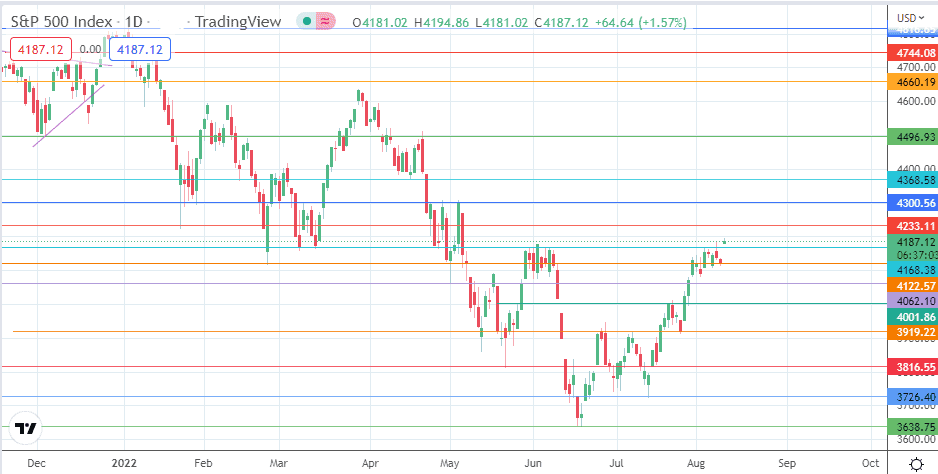

A bounce on the current 4122 support level is expected, which could take the price action above the 7 June/8 August resistance at 4168. If this happens, it sets the bulls free for another push higher, targeting 4233 (27 April high) and potentially 4300 (psychological mark and 9 March/4 May highs). Beyond this level, 4368 (14 February and 18 April lows) and 4496 (21 January and 21 April highs) form additional targets to the north.

On the other hand, a decline below 4122 gives the bears access to extend the correction toward 4062 (10 May 2022 high) and possibly the 4000 price mark (25 May high and 28 July low). Additional downside targets are seen at 3919 (26 July low) and 3816 (20 May and 18 July lows).

S&P 500 Index: Daily Chart