- Silver price has crawled back recently as investors refocus on the upcoming Jackson Hole Symposium and the slowing global economy.

Silver price has crawled back in the past few days as investors refocus on the upcoming Jackson Hole Symposium and the slowing global economy. It rose to a high of $19.27 on Thursday morning, which was about 2.9% above the lowest level this week. This price is still much lower than this year’s high of $26.

Slowing economy and Jackson Hole

Silver price has bounced back even after the relatively weak economic data published this week. On Tuesday, numbers by S&P Global showed that the manufacturing and services PMIs in most countries were deteriorating sharply. For example, in Europe and the United States, the PMI dropped below the expansion level of 50.

Earlier this week, the Chinese central bank decided to slash interest rates in a bid to support the economy. Recent data shows that the country’s economy is slowing dramatically. For example, the property bubble has burst while industrial production has slipped. These numbers are important for silver because it is an industrial metal.

The next catalyst for the XAG/USD price will be the Jackson Hole Symposium that starts on Friday. This meeting will provide central bank governors to reset expectations. For one, it will be the first speech by Jerome Powell after the recent inflation report. As such, a more hawkish tone will lead to a stronger US dollar, which will push silver prices lower.

Silver price forecast

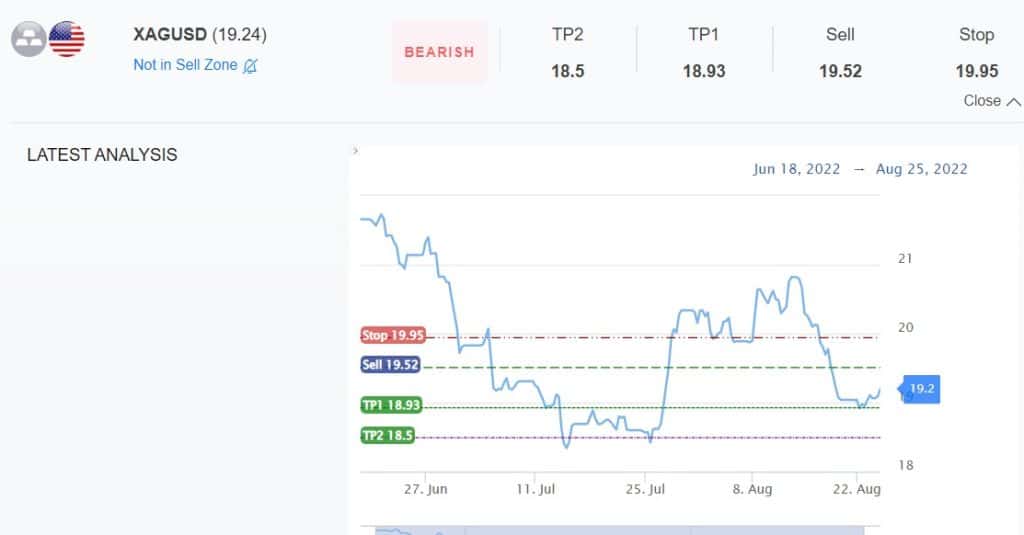

The four-hour chart shows that the XAG/USD price formed an ascending double-top pattern earlier this month. It then moved below the neckline of this pattern at $19.52 on August 18. The metal remains slightly below the 25-day and 50-day moving averages while oscillators are pointing upwards. It is also below the standard pivot point.

Therefore, silver will likely continue rising and then retest the double-top neckline at $19.52. After this, it will resume the bearish trend and move below this month’s low of $18.70. This view is supported by the highly accurate InvestingCube S&R indicator. It estimates that the metal will retest the support at $18.50 soon.