- Silver price has moved sideways in the past few days. We explain what to expect as the crisis in Ukraine escalates.

Silver price has been in a tight range in the past few days as investors continued to watch the ongoing crisis in Ukraine. It is trading at $24.30 per ounce, which is about 5.20% below the highest point in February. It remains about 6% above where it started the year at. This performance mirrors that of gold, which has also jumped by about 5.52% this year.

Silver has exposure in the ongoing crisis in Ukraine in a number of ways. First, there is a likelihood that silver’s supply will be constrained in the coming months because of the vast amount that is mined in Russia. For one, a company like Polymetal is the second-biggest silver producer in the world. This explains why the Polymetal share price crashed by more than 50% on Monday.

Silver latest news

Second, there is a likelihood that the ongoing crisis will lead to a stronger dollar as investors rush to safety. Historically, silver tends to have an inverse relationship with that of the US dollar. Another reason why the US dollar will likely strengthen is that the Federal Reserve will be more aggressive starting from this month in a bid to slow inflation.

On a positive side, silver tends to have a close correlation with gold, which explains why its price jumped by more than 6% in February even as American and European equities declined.

Silver price prediction

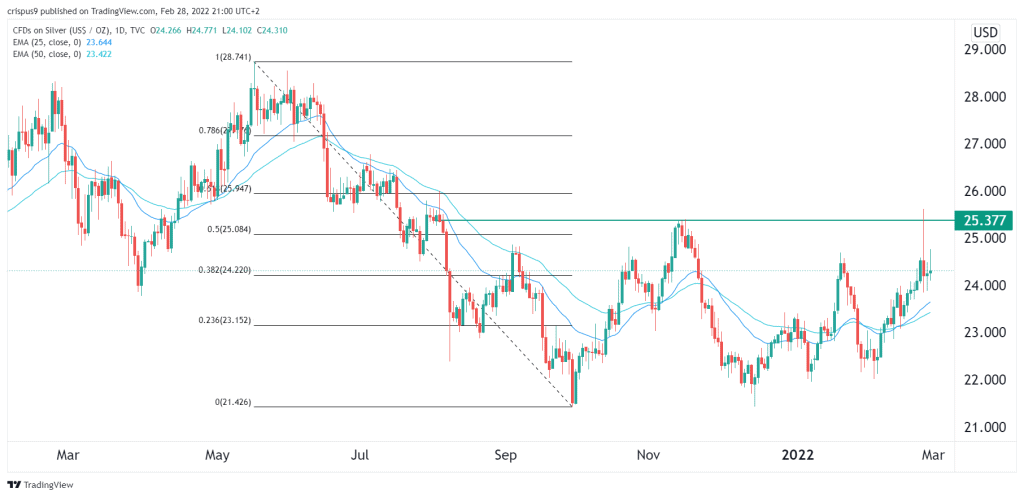

The daily chart shows that the silver price has been in a strong bullish trend in the past few weeks. As it rose, the metal managed to move above the key resistance level at $25.37, which was the highest point on November 15th last year. It moved above the 25-day and 50-day moving averages. The metal also rose above the 38.2% Fibonacci retracement level.

Therefore, there is a likelihood that the silver price will maintain a bullish trend in March as investors target the next key resistance at $27, which is along the 78.2% retracement level. This vie will be invalidated if it moves below $22.