- The silver price has done well recently even as worries about the Federal Reserve remain. We explain what to expect.

The silver price has done well recently even as worries about the Federal Reserve remain. It is trading at $22.52, which is about 2.85% above the lowest level this month. This price is also about 12% below the highest level last year.

Silver is both a precious metal and an industrial metal. As a precious metal, its price is usually affected by the actions of the Federal Reserve. On the other hand, as an industrial metal, silver does well when the economy is doing well because of the rising demand.

The biggest concern about silver traders recently is that the Fed is expected to start tightening monetary policy in a bid to deal with the rising inflation. Analysts expect that the Fed will end its quantitative easing policy in March and then start hiking interest rates right away.

On a positive side, there is still strong demand for silver as the world economy reopens. This is evidenced by the fact that manufacturing and industrial production has been rising recently.

The next big catalyst for the silver price will be a testimony by Jerome Powell. In his prepared remarks, he said:

“We know that high inflation exacts a toll, particularly for those less able to meet the higher costs of essentials like food, housing and transportation. We are strongly committed to achieving our statutory goals of maximum employment and price stability.”

The testimony will come a day ahead of the latest US consumer inflation data. Analysts expect the data to show that the headline CPI rose to 7% in December while core CPI jumped to 5.4%.

Silver price prediction

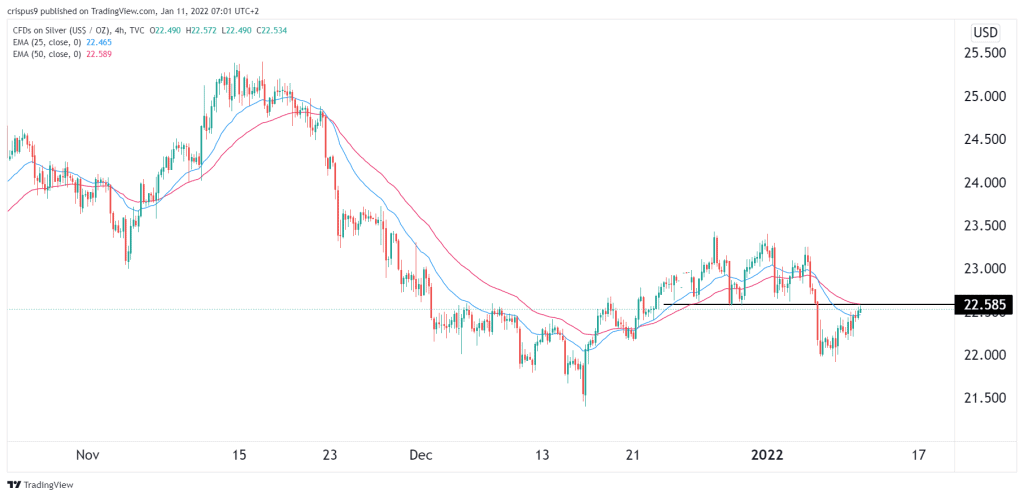

The four-hour chart shows that the silver price has been in a bullish trend in the past few trading sessions. It is attempting to move above the 25-day and 50-day moving averages.

However, a closer look shows that it is forming a rising wedge pattern, which is usually a bearish sign. It is also slightly below the key resistance at $22.58, which was the neckline of the double-top pattern that happened in December. Therefore, this rebound is a break and retest pattern.

As such, there is a likelihood that the silver price will resume the downward trend and retest this month’s low at around $22. This view will be invalidated if it moves above $23.