- Silver price remains under pressure as the gold/silver ratio soars to the highest point since July 2020. The XAG/USD price is trading at 19.85

Silver price remains under intense pressure as the gold/silver ratio soars to the highest point since July 2020. The XAG/USD price is trading at 19.85, which is about 26% below the YTD high. It is also slightly below the lowest level in 2020. Other precious metals like palladium, platinum, and palladium have all retreated sharply.

Gold/silver ratio soaring

Silver has had a difficult period recently as concerns about the strong US dollar and a recession remains. The US dollar index has jumped sharply as the Federal Reserve has embraced a more hawkish policy. The Fed has already hiked interest rates by 150 basis points and hinted that more hikes are coming.

Other central banks have also moved to tighten conditions. For example, the Bank of England has hiked rates in the past five straight meetings. The Swiss National Bank hiked interest rates for the first time in more than a decade. Therefore, these policies have pushed more analysts to price in a slow and painful recession and stagflation.

Meanwhile, silver price has dropped as investors continue dumping silver funds. According to Bloomberg, gold-backed ETFs dropped by 1% in the second quarter. In the same period, silver ETFs tumbled by about 5%. An analyst told Bloomberg: “If market recession fears are increasing, you prefer to hold exposure to gold and not to the white metals, which have a high industrial usage.”

Meanwhile, the closely watched gold/silver ratio has been in a strong bullish trend and is currently trading at $91.23, which was the highest point since June 2020. This means that an ounce of gold is currently valued at over 91 ounces of silver.

The key catalyst for the silver price this week will be the upcoming American jobs data. Analysts expect these numbers to reveal that the labor market slowed in June as confidence dropped. Still, these numbers will likely not have an impact on the Federal Reserve.

Silver price prediction

The daily chart shows that the XAG/USD price has been in a strong bearish trend in the past few months as demand for silver wanes. Silver price managed to move below the important support level at $21.44, which was the lowest point in September and November last year.

It also moved below the important psychological support at $20. Therefore, it now seems like bears are in control and that the silver price will continue falling in the coming weeks. If this happens, the next key support to focus on will be $15.

XAG/USD S&R levels

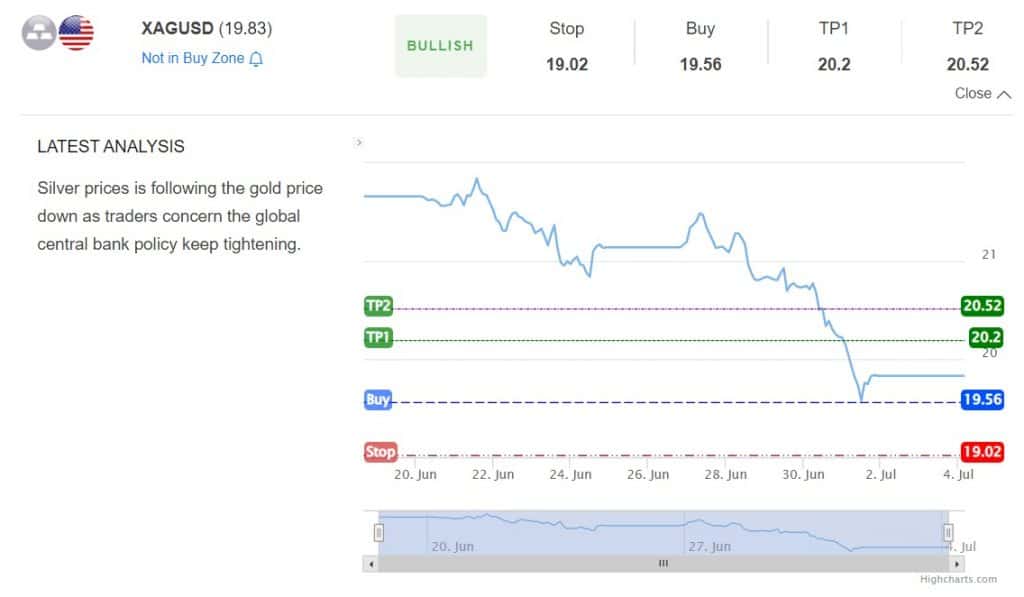

In the immediate short-term, the XAG/USD pair will likely crawl back, according to the closely-watched S&R indicator by InvestingCube. The indicator expects that silver will rise to $20.1 and possibly $20.52. The stop-loss for this trade will be at $19.56.