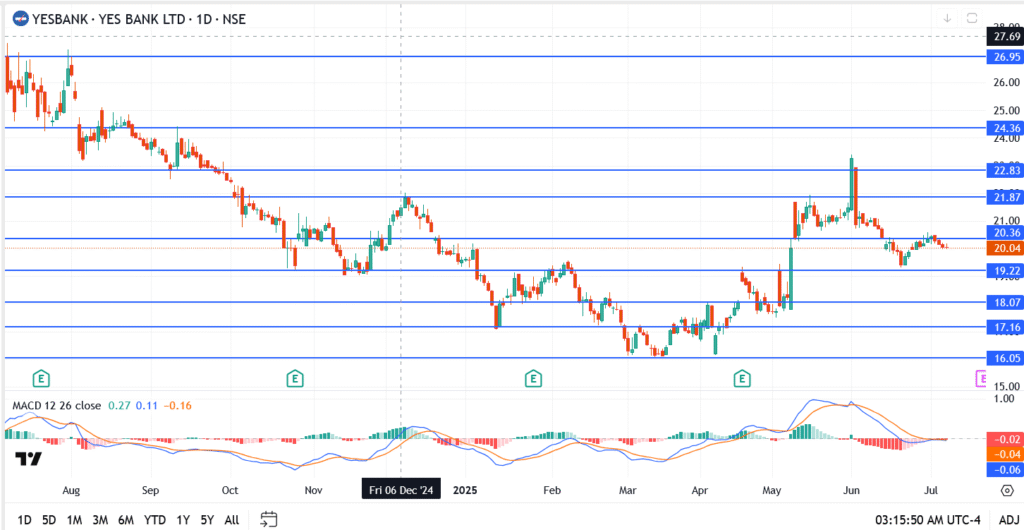

YES Bank shares are struggling to hold above ₹20 after an initial rebound in June lost steam. The stock last traded near ₹20.04, just under a key short-term pivot, as news broke that the lender has paused its CEO hunt amid delays in the high-stakes ₹13,482 crore SMBC deal.

The move raises fresh concerns about leadership continuity and timeline risks for the proposed stake sale to Sumitomo Mitsui Banking Corporation, which still awaits regulatory clearance.

CEO Hunt Paused as SMBC Stake Deal Awaits Greenlight

According to sources, YES Bank has quietly paused its search for a new chief executive while the SMBC transaction remains in regulatory limbo. The Japanese banking giant is set to acquire a substantial 20% stake in YES Bank, but no final approval has been granted yet.

For a stock that surged earlier this year on deal optimism, the latest development is a reality check. Without leadership clarity or deal closure, bullish momentum is quickly fading.

YES Bank Share Price Analysis

- Current Price: ₹20.04

- Resistance: ₹20.36, then ₹21.87

- Support Zones: ₹19.22, ₹18.07

Outlook

YES Bank’s technical structure is losing strength, and the pause in its CEO appointment adds uncertainty to an already fragile setup. Until the SMBC stake sale clears and a leadership roadmap emerges, investors may tread cautiously.

For now, the ₹19.22 support level is the last line holding the structure together. If that gives way, YES Bank may revisit the deeper consolidation zone from April.