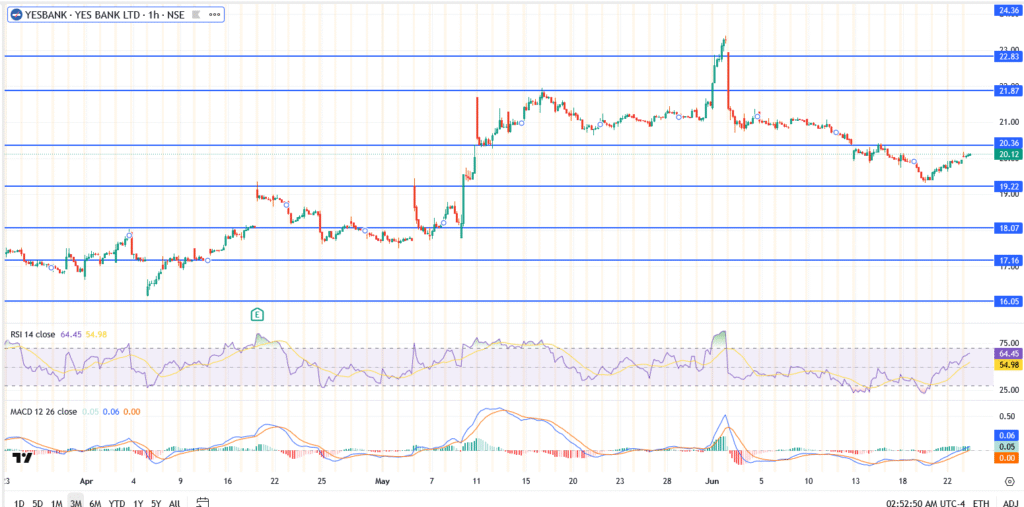

- Yes Bank share price nears ₹20.36 resistance as NPA recovery boosts sentiment, but global risks and RBI rate cuts keep traders cautious.

Yes Bank share price continued its short-term recovery on Tuesday, rising toward ₹20.12 in the early session, after gaining 0.8% on Monday. The upside has been fueled by improving sentiment around the lender’s asset quality and a wider bounce in Indian equities. Still, markets remain jittery following Iran’s overnight missile strike on a U.S. air base a move that briefly rattled global risk sentiment.

The RSI is hovering around 64.45, inching close to overbought territory. At the same time, Yes Bank is running into familiar resistance near ₹20.36. A level that’s blocked rallies twice this month. If buyers can’t clear it convincingly, the stock could run out of steam and see a pullback.

The latest recovery in the stock was largely driven by the ₹201 crore NPA recovery, which lightened its stressed asset load.

Tension is still in the air after Iran fired missiles at the U.S. military’s Al Udeid base in Qatar. Making investors more cautious, especially in rate-sensitive sectors like banking.

Yes Bank Share Price Forecast Today

- Current price: ₹20.12

- Resistance zones: ₹20.36, then ₹21.87

- Support levels: ₹19.22, then ₹18.07

A daily close above ₹20.36 could spark fresh momentum and open the path toward ₹21.87. On the flip side, failure to break out may invite profit-taking back toward the ₹19.22 support zone. In the short term, Yes Bank is balancing improving fundamentals against global macro risk and traders remain on edge.