- Yes Bank share price has registered the third successive loss-making session and its latest financials could worsen things.

Yes Bank share price dipped slightly to around ₹20.05 on Friday, down from yesterday’s close of ₹20.15. While the move wasn’t drastic, it reflected a cautious investor reaction to the bank’s Q1 FY26 business update, which came out earlier in the day.

On the surface, the numbers painted a mixed picture. Loans dipped 2% sequentially to ₹2.41 lakh crore, while deposits fell 3% to ₹2.75 lakh crore. For a bank trying to regain its growth stride, that sort of contraction raised some eyebrows.

However, it wasn’t all gloomy. The bank’s credit-to-deposit ratio climbed to 87.5%, suggesting it’s still deploying funds efficiently despite the decline in volumes. More importantly, Yes Bank’s liquidity coverage ratio improved significantly—up from 125% to 135.7%. That signals that the bank is strengthening its short-term buffers. That increase in liquidity helped soothe some nerves and was likely the reason the share price bounced back from its intraday low of ₹19.98.

For now, the stock seems to be holding its ground around the ₹20 mark, as investors weigh the early signs of operational stress against the prospects of growing financial stability. Ultimately, the mixed update is prompting some to stay cautious, but not pessimistic. Much will depend on how Yes Bank (NSE: YESBANK) manages deposit growth and asset quality in the quarters ahead.

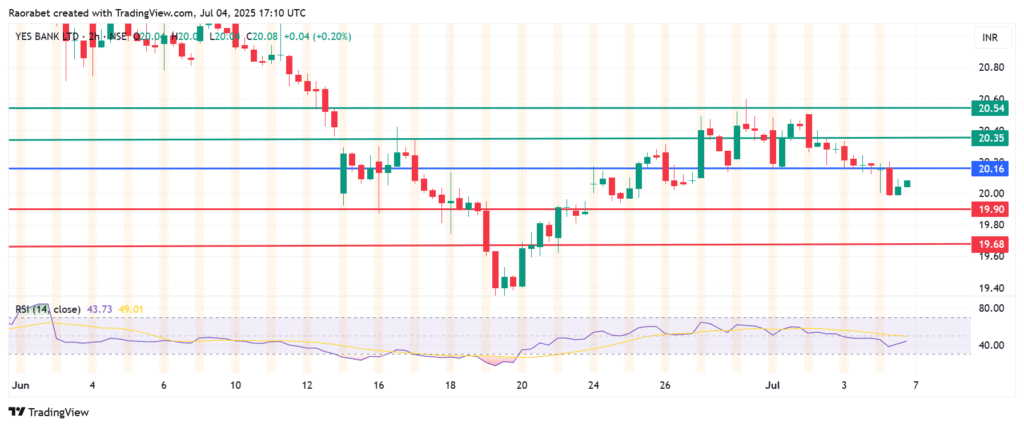

Yes Bank Share Price Prediction

The momentum on Yes Bank share price calls for further downside if resistance persists below ₹20.16. That will likely see initial support established at ₹19.90. However, an extended control by the sellers will break below that level and potentially test ₹19.68.

On the other hand, going above ₹20.16 will invite the buyers to take control. That momentum will push the stock higher, with the first resistance likely to be at ₹20.35. The downside narrative will be invalid above that level. Furthermore, the resulting momentum could push the price higher and test ₹20.54.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.