- XPeng trades near key technical levels ahead of quarterly results, while Chinese equities extend gains on strong inflows. This report highlights major market drivers, from central bank decisions to inflation data and growth updates shaping investor sentiment this week.

After bouncing from July lows at 17.29, XPEV’s near-term advance stalled at 21.61. The shares recently traded around 19.70, mid-range, making those two levels key markers to watch for a breakout.

XPEV – Daily Chart

Sector sentiment softened last week after China tightened scrutiny on aggressive price cuts amid intense competition. The China Association of Automobile Manufacturers (CAAM) reported that July EV deliveries (passenger and commercial) fell 5% month over month to 1.26 million units.

XPEV latest news

Earnings preview: XPeng reports on Tuesday. Consensus from Visible Alpha points to a second quarter net loss of 940.9 million yuan (about US$131 million), narrowing from a 1.28 billion yuan loss a year earlier. Revenue is expected at 18.69 billion yuan, up from 8.11 billion yuan a year ago. The company also posted a record 103,181 deliveries in the quarter.

Stock performance & outlook: Shares declined 10% in the second quarter amid policy uncertainty and softer demand in China’s auto market. Even so, current trends have XPeng on track by many estimates to reach profitability in the fourth quarter.

Catalysts: New model launches in the second half of the year support Nomura’s view that XPeng is entering a stronger uptrend, with higher shipments, improving average selling prices, and expanding margins. Management’s guidance this week will be critical, a breakout above 21.61 or a retest of 17.29 is possible. Any easing of price-cut pressures could further lift sales of premium models.

Other update: XPeng said this week its new P7 electric sedan completed a 24-hour, 4,000 km endurance run, setting a new record.

Chinese Shares Push Higher Despite Recent Data

Investors are also turning their attention to Apple after Elon Musk threatened legal action against the iPhone maker.

CHINA 50 – Daily Chart

The CHINA 50 index is grinding higher into recent resistance and is now testing the late 2024 highs, an important checkpoint for the medium-term trend.

Mainland equities advanced, with the Shanghai Composite up 0.9% to 3,728 on Monday, its strongest close since August 2015. The index has gained about 20% since the tariff driven bottom in April–May. Sentiment improved on news of an extension to U.S.–China trade talks and hopes for a deal.

Wang Huan said: “We’re confident that this rally has legs”, a fund manager at Shanghai Zige Investment Management.

Investors still expect additional policy support, while flows have rotated out of fixed income as analysts dial back forecasts for further monetary easing.

Trading activity has surged: turnover on mainland exchanges topped 2.7 trillion yuan (US$376 billion) on Monday, the second highest on record, according to Bloomberg. Southbound flows into Hong Kong also jumped, with a record HK$35.9 billion (US$4.6 billion) of purchases on Friday.

On the other hand, a regulatory filing showed the world’s largest hedge fund, Bridgewater Associates, exited all of its Chinese equity holdings in the second quarter, selling positions in Alibaba, JD.com, and PDD Holdings, and closing stakes in Baidu, Nio, and Trip.com. The firm appears to have rotated back into U.S. megacaps, adding Nvidia, Microsoft, and Alphabet.

Weekly Key Preview: New Zealand Likely to Restart Rate Cuts, Jackson Hole Symposium Kicks Off

This article provides a forward-looking analysis of global economic events and data releases in the coming week, with a focus on the Reserve Bank of New Zealand (RBNZ) potentially resuming rate cuts and the high-profile Jackson Hole central bank symposium. It will also track U.S. housing data, Canada CPI, U.K. and eurozone CPI, the Federal Reserve’s meeting minutes, global PMI prints, as well as Germany’s GDP and retail sales in the U.K. and Canada.

UK CPI:

Mon–Tue: U.S. housing data, Canada CPI

As usual, Monday’s calendar is relatively light. The eurozone will release June trade figures, and the U.S. will publish the August NAHB Housing Market Index in the evening, where markets hope to see continued stabilization.

On Tuesday, attention stays on U.S. housing with July housing starts and building permits. June’s data showed starts beating expectations, suggesting that U.S. residential construction retains some resilience despite high interest rates and economic uncertainty.

Although the recent increase in building permits has been modest, the fact that permits are still rising, despite elevated mortgage rates and subdued sentiment, signals developers remain confident about future demand. Housing is a leading indicator for U.S. domestic demand and consumer momentum; in an environment of high inflation and shifting labor market dynamics, housing activity helps gauge real purchasing power and market mood.

On Tuesday evening, Canada will release July CPI. Markets will watch whether the year over year rate stays below 2% or ticks up due to tariff effects, which could keep the Bank of Canada patient about further cuts. Current market expectations are for the policy rate to fall to 2.25% by year end.

Wed: RBNZ decision; U.K. & eurozone CPI

On Wednesday, the RBNZ announced its rate decision. Softer labor market data, subdued inflation expectations, and slower wage growth have led markets to price in a possible 25 bp cut. At its last meeting, the RBNZ held rates at 3.25%. After one of the most aggressive tightening cycles in its history to curb inflation, it has lowered rates by a cumulative 225 bp since last August. The latest RBNZ projections suggest the Official Cash Rate (OCR) could drop below 3% by year-end.

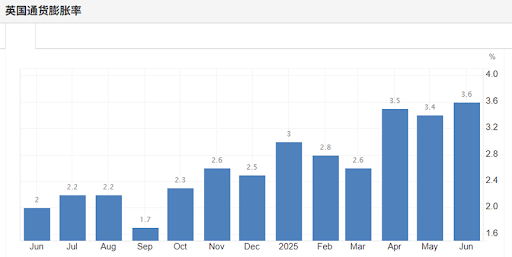

During the European session, focus turns to CPI reports from the U.K. and the eurozone. U.K. CPI for June unexpectedly rose to the highest level in more than a year, beating economists’ forecasts. The Bank of England cut rates last week but delivered a hawkish-leaning message; if CPI accelerates for a second straight month, it could make the BoE more hesitant about another cut in November. The eurozone’s final July CPI is expected to hold at 2% year over year within the ECB’s target supporting a continued wait-and-see stance on further easing.

UK inflation rate:

Thu: FOMC minutes; Jackson Hole Symposium

Early Thursday, the Fed will release minutes of its latest meeting, and markets will look for more detail on policymakers’ views toward rate cuts. Attention then shifts to the annual Jackson Hole Economic Policy Symposium, one of the most important global central bank events. Fed Chair Jerome Powell will deliver a key address, which markets will watch closely to gauge the policy path for the rest of the year. The Fed may even hint most directly at a September rate cut.

On the data front, countries will publish flash August PMIs for manufacturing and services. For manufacturing, the focus is on the eurozone, the U.K., and the U.S. Previous data showed that the eurozone manufacturing industry is approaching the boom bust line, a three year high so the question is whether it can return to expansion.

The U.K.’s July manufacturing PMI hit a six month high but remained in contraction. The U.S. July ISM manufacturing PMI showed the fastest contraction in nine months; if the data weakened further, it would heighten slowdown risks. Services PMIs are expected to hover around the cusp of expansion, but watch for signs of fading momentum.

Fri: Germany GDP; U.K. & Canada retail sales

Friday’s focus is Germany’s final Q2 GDP, to see whether the previously reported 0.1% quarter on quarter contraction is confirmed. In addition, the U.K. and Canada will release retail sales. For the U.K., investors will watch whether July retail sales extend last month’s rebound; warmer weather and seasonal sports events such as Wimbledon boosted spending, and July may retain those seasonal tailwinds.

Traders are focused on the $17.29 support level and the $21.61 resistance level. The stock is currently near $19.70, which leaves room for either a breakout above resistance or a pullback toward support. These levels will guide near-term momentum.

Analysts expect a smaller net loss of 940.9 million yuan in Q2 versus 1.28 billion yuan last year. Revenue is projected to more than double, helped by record deliveries of over 103,000 vehicles. The numbers highlight progress toward profitability, potentially lifting confidence ahead of year-end.

Policy direction in China remains a key driver. Stricter oversight of price competition could stabilize margins across the EV industry, while additional government incentives or supportive infrastructure policies would likely accelerate adoption and benefit leading players like XPeng.