- Amazon stock has a history of performing well during Black Friday. We assess whether it will still climb amid the many risks this time around.

If you’re keeping an eye on Amazon (NASDAQ: AMZN) you’re probably wondering if the stock can get its funk after the latest earnings release. As of this writing, AMZN is trading around $185, but that’s down 2% this week due to all the uncertainty floating around about tech bubble tariffs and the Fed. The question is, are the current market conditions likely to change with Black November season coming in?

Recent Black Friday History

Last Black Friday, Amazon had a huge 9% year on year sales jump in North America, with Q4 sales coming out at $41 billion per their latest earnings call. Meanwhile, their AWS cloud services are still raking in a steady 13% + revenue increase. Analysts at Wedbush Securities are pretty optimistic, putting out a $220 price target and saying that Black Friday is could have substantial revenue implications for Amazon. This is especially key since we saw a 15% spike in online traffic in early November according to Adobe Analytics. That traffic spilled over from Prime Day and was really good news for the company.

What are the potential downsides?

Not everything is going to be rosy, though. The fact that inflation is still sitting at 3.1% is probably going to make some people think twice about making big purchases. And its not just Amazon that’s tightening its game. Walmart is also ramping up its same-day delivery game and that’s going to give Amazon a run for its money. Barclays reckons that if logistics costs rise Amazon could end up with a 3% squeeze on its margins.

One thing you also need to keep in mind is that other bits of the business like Amazon Web Services (AWS) and advertising revenue tend to have a bigger impact on the company’s bottom line than any short-term boost in retail sales. So while Black Friday might be a big deal, it’s not the only thing that’s going to determine the long-term health of Amazon’s stock.

The AMZN stock technical chart

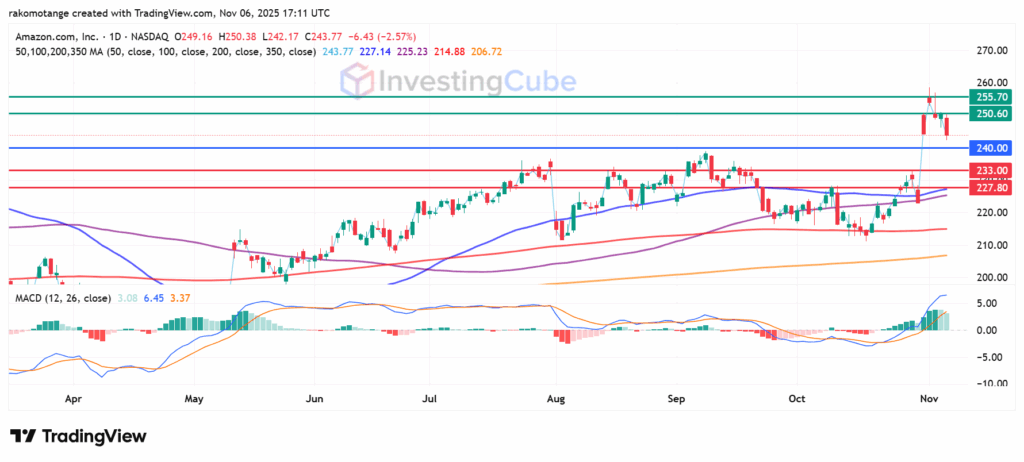

The daily chart shows AMZN price above the 50 day moving average of $243 – that’s a pretty bullish position given its still above the 200-day average at $214. Also, we’ve had a golden cross intact since September which basically just means the trend is still going up.

Support levels are at $233 and $227 and if the stock falls below those it could be in trouble. On the other hand, there’s likely to be primary resistance at $250 and a secondary one at the $255. Meanwhile, the MACD line adds support to the bullish narrative.

Amazon stock price 1-day chart on November 6,2025. Source: TradingView

Positive sales news generates bullish sentiment around AMZN stock. However, investors generally expect a successful shopping season. Therefore, medium-term stock movement will likely be impacted more by the company’s broader financial guidance for the full holiday quarter.

The stock market is forward-looking, meaning anticipated success is usually “priced in” well before the event.

With shares near key moving averages, now is a solid entry point. However, investors should wait for resistance breaks to confirm upward momentum.