- Shell share price has defied the odds, shaking off its profit miss via share buyback program that has given investors confidence

- The company's upstream business continues to be its biggest revenue generator

- Oversupply of crude oil is an existential threat to the oil company's growth plans in 2026

Shell stock (LSE: SHEL) has been doing well in early 2026. As of this writing, it’s up over 5% since the year began, with shares around $78.91 on the NYSE and about £28.94 on the LSE. This is noteworthy since the company’s full-year and Q4 2025 results, reported on February 5, were a mixed bag. Here’s what’s keeping the stock up despite the profit dip and what it could mean moving forward.

Profit Miss vs. Revenue Reality

The earnings report from early February was a bit of a riddle. Shell’s adjusted earnings were $3.3 billion, a bit short of the expected $3.5 billion. Usually, an 11% drop in profit from the previous year would worry investors. But, revenue told a different story. It beat expectations, coming in at $43 billion, thanks to higher volumes in its Upstream and Integrated Gas areas. J.P. Morgan analysts, among others, noted that Shell’s ability to keep up buybacks and dividends in a changing energy market is a good sign compared to some competitors.

Is Shell Worth Buying at Current Valuations?

Many believe oil companies can hedge against inflation. I’d say Shell is more than that, it’s becoming a total return machine. With a P/E ratio of about 13x, which is less than its usual 20x over the past year, the price looks appealing. Plus, Shell’s current price gives it a good forward price-to-earnings ratio and a dividend yield over 4%, which is attractive to many investors who want income.

Some RBC analysts are concerned about Shell’s declining reserve life, now at 7.8 years. But the company’s strong $3.5 billion quarterly share buyback works as a good safety net. It seems investors are paying more attention to Shell’s financial management and returns to shareholders than the lower earnings numbers.

The buyback plan shows they’re confident in making money, even if oil prices drop. This focus on returns has supported the share price, helping it get through the initial reaction to the earnings report. The market has liked Shell’s strong cash flow and commitment to giving back to shareholders.

The $9.4 billion operating cash flow in Q4 alone shows they are running things well and are strong in the Upstream and Integrated Gas segments. But, judging the stock is complicated. The stock’s strength shows it has a value plus yield appeal. However, it also depends on oil prices staying steady and new energy projects succeeding. If these don’t turn out as expected, the risk/reward balance may not be as good.

Shell Share Price Forecast

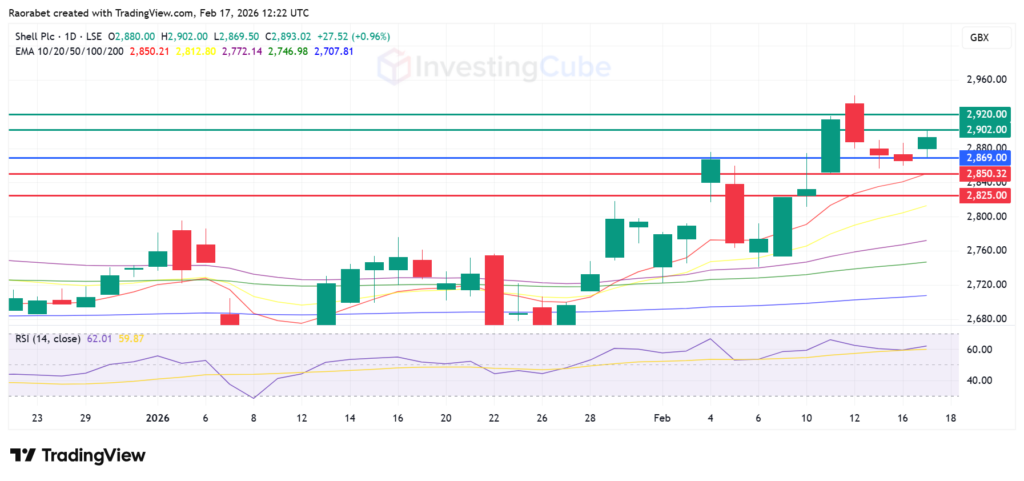

The Shell share price RSI is at 61, affirming strong bullish control. The upside will likely prevail if the buyers keep the stock above 2,869p. Primary resistance is at 2,902p and a break past that could enable it to test 2,920p. Immediate support is at the 10-day EMA at 2,850p, with a major support level at 2,825p.

Shell share price on the daily chart with resistance and support levels on February 17, 2026. Created on TradingView

Investors cared more about Shell’s big cash flow and commitment to a $3.5 billion buyback than the $200 million earnings miss. The company’s ability to beat revenue forecasts and meet cost-cutting goals early showed they are running things well.

The primary risk is a crude oil glut. If global demand softens or OPEC+ increases supply, Brent prices could drop, squeezing Shell’s Upstream margins, which remain the company’s biggest profit engine.

Strong cash flow and operational efficiency made up for lower profits. The results are showing sensitivity to oil prices and the speed of the energy transition.