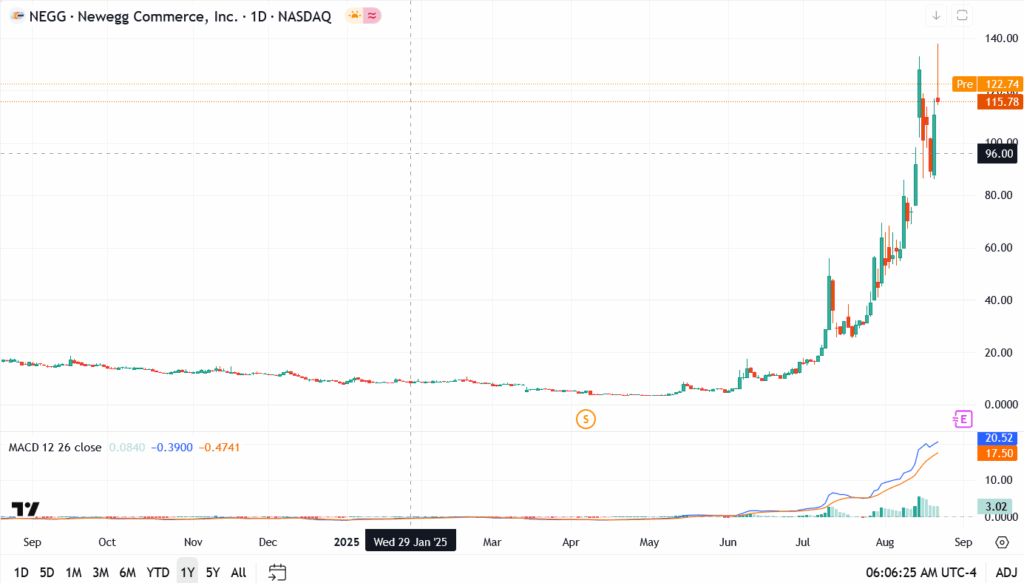

Newegg Commerce (NASDAQ: NEGG) shares soared 22% on Wednesday, extending a wild run that has lifted the stock more than 1,300% this year. The rally pushed NEGG to an intraday peak near $133 before profit-taking set in. On Thursday, the stock snapped lower, closing near $96, only to rebound in pre-market trade on Friday with quotes back around $122. The roller-coaster moves reflect the tug-of-war between momentum traders chasing upside and skeptics betting on a sharp unwind.

What’s Behind Newegg’s Rally?

The surge came after Newegg said its board’s Pricing Committee approved the sale of another 500,000 common shares on Aug. 17 under a $65 million agreement with Needham & Company. The company had already raised $29.3 million in July from a one-million-share sale. Depending on market conditions, the number of shares sold could shift.

At the same time, a messy shareholder loan has fueled volatility. Fred Chang, Newegg’s second-largest shareholder, defaulted on loans backed by nearly two million shares. East West Bank foreclosed on about 660,000 shares in June and is still pursuing another 100,000 tied to Chang’s affiliate, Tekhill USA LLC.

Governance changes are also reshaping the story. Chang resigned from the board in July, replaced earlier this month by CEO Anthony Chow, who has led Newegg since 2020. Insider filings, meanwhile, show continued selling by Yong Feng Hou, with small blocks unloaded in August.

Adding fuel to the speculation, short sellers have circled in. Martin Shkreli, the former pharma executive, said he is betting against Newegg after its massive run, calling the stock “close to worthless.”

Newegg Stock Technical Analysis

- Current price: $115.78 (pre-market $122.74)

- Pivot level: $112.00

- Immediate resistance: $126.50, then $133.00 (52-week high)

- Support: $96.00, then $80.00; deeper cushion near $60.00

NEGG has gone parabolic, trading 173% above its 50-day simple moving average and nearly 580% above its 200-day. The chart shows Wednesday’s move pushing into resistance, with volatility still extreme.

Newegg Price Prediction: Can NEGG Hold Its Rally?

The bullish case leans on momentum. If NEGG clears $126.50 with conviction, the 52-week high at $133 comes into play fast. On the downside, failure to hold above $112 risks a sharp pullback toward $96 or even $80 as profit-taking kicks in. With short sellers circling and insider sales ongoing, Newegg is a high-risk, high-reward trade, one that could reward disciplined entries but punish late buyers.